Getting into Gold: Why Should I Buy Gold?

Our experts look forward to discussing all options you have to make the right decision for your specific needs! Contact us today to arrange for a consultation.

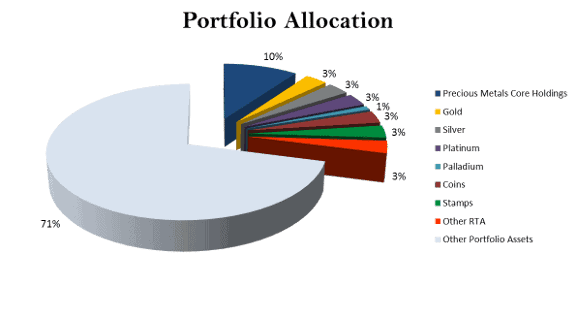

Experts suggest that the bulk of your portfolio should be in traditional assets like stocks, bonds and real estate, but a portion of your portfolio should also be in alternative assets with proven track records like physical gold and silver bullion; bars or coins.

Unlike paper currency or other assets, gold has maintained its value for literally thousands of years. Gold has historically been an excellent hedge against inflation, because its price tends to rise when the cost of living increases. Why wouldn’t you take advantage of gold’s staying power as a wise investment class?

Gold’s negative correlation to the stock market and paper currency has benefited gold investors for a long time. The spot price of gold has historically risen when the U.S. dollar weakened and when the stock market faltered. Investors have seen gold prices soar and the stock market plunge during periods of high inflation. In addition to financial insecurity, gold is also known as a crisis commodity for its ability to maintain or even grow in value during times of geopolitical uncertainty.

Demand for gold has also grown among investors. Many are beginning to see commodities, particularly gold, as an investment class into which funds should be allocated. Central bank gold buying has also significantly contributed to international demand.

What are Good Investment Goals for Gold?

Do you want to build wealth? Establish a portfolio that will yield passive earnings? Are you saving funds for events that will happen five years from now, or thirty? How much will you need?

Having a diversified portfolio will provide some protection from the volatility of other riskier asset classes. Combine gold with stocks and bonds in a portfolio to reduce the overall volatility and risk. Do your research or seek advice from experts to make sound, informed decisions on how to diversify your portfolio using gold and other precious metals.For pretty much everyone, the starting point is your core holdings.

Core holdings, or wealth insurance, is a store of purchasing power, in a form with high liquidity, for a potential financial crisis you hope to never have.

Therefore, core holdings tend to be 10% of your portfolio. Core holdings should (hopefully) remain untouched for the remainder of your life. Your core holdings should be primarily gold, and some silver. Your core holdings should be close at hand.

Investors focused on holding for the long term should give priority to finding the lowest premium. In a bull market for precious metals, it is the ounces you own that will produce the investment returns. The lower the premium the more ounces you will acquire. As a general rule, premiums can be expected to fall as a percentage of the value of a coin, round, or bar as precious metals prices rise. The combination of low prices and a low premium is much rarer, and worth taking advantage of, especially when markets are bearish.

This is the exact situation we find ourselves in today… relatively low prices and uncommonly low premiums.It bears mentioning that you should always remember to consider the marketability of what you buy. For example, most investors should avoid 1,000-ounce silver bars. Larger bars carry low premiums, but are not as divisible and you will encounter a much smaller pool of prospective buyers, if you are looking to resell.

Generally, you do not trade in and out of your core holdings. You only sell that material when you have a financial crisis. Economic and political uncertainty is a given, so you absolutely cannot risk giving up your core position.

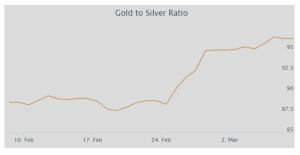

However, there are opportunities to increase the ounces in your overall holding by swapping one metal for another – trading the Gold/Silver Ratio (GSR). Silver price gains often tend to outpace those of gold—to the upside or downside, and with the right GSR, it may then make sense to swap silver for gold. Savvy metals investors have used this technique to reap even greater returns – without ever jeopardizing their position in this bull market for precious metals.

Currently at levels in the mid-90s, this ratio favors over-weighting silver. Combine the current GSR with some pretty compelling supply and demand fundamentals, and it appears silver will begin to outperform gold over the medium to long term. General guidelines:

General guidelines:

- Buy gold if your priorities are wealth insurance and safety with lower volatility and risk.

- Buy silver if you want a combination of wealth preservation and greater potential appreciation.

- Buy some platinum or palladium if you want to diversify your precious metals holdings into alternative metals with their own unique fundamentals.

The good news is that the early stages of a bull market are an opportune time to add precious metals to your portfolio for wealth insurance and take advantage of rising spot prices for profit potential.

For more on precious metals, including storage, pricing, buying and selling, please contact us here to begin the discussion on your portfolio allocation and add to your position in gold, silver, platinum, and palladium. About The Author

Rich Checkan, ASI President

As the President and COO of ASI, Rich has knowledge of every facet of ASI’s operations. He has been an integral part of ASI’s maturation from a precious metals and foreign exchange dealer to a full service tangible and rare tangible asset provider—to include rare U.S., world, and ancient coins. Rich oversees the operations, administrative, sales, and marketing departments, as well as serving as ASI’s Compliance Officer.

If you enjoyed this article, here are a couple more suggestions:

Gold – Cleared for Takeoff?

Getting into Gold Part 3: Why is Gold Important Now?

Contact Author

"*" indicates required fields

Stay Ahead on Every Adventure!

Stay updated with the World News on Escape Artist. Get all the travel news, international destinations, expat living, moving abroad, Lifestyle Tips, and digital nomad opportunities. Your next journey starts here—don’t miss a moment! Subscribe Now!