Last month, I addressed the question on everyone’s mind: “When will gold move higher?”

This month, we may very well have our answer.

There are several reasons why gold should be moving higher in price:

- Near zero interest rates.

- Negative real interest rates.

- Signs of inflation everywhere.

- $28 trillion in debt.

- Civil unrest throughout the world.

- Destabilizing geopolitical events in Afghanistan and elsewhere.

- Valid concerns about overheated equities markets.

- Gold / Silver Ratio (GSR) hovering around 76.

- Hyperbolic monetary expansion worldwide.

There is no question I can add to that list, but that’s just off the top of my head in a couple of minutes. And, quite honestly, that’s more than enough to kick gold into action with higher prices.

Headwinds

Yet, to date, gold has not responded. Let’s look at what has kept gold in check to date. Then, I’ll share why I believe there is a change afoot.

First, I believe we should look at the Federal Reserve. Monthly readers know I have been uber-critical of Chairman Jerome Powell and his merry band of spin doctors.

Personally, I prefer a Federal Reserve that is not politically manipulated. I prefer a Federal Reserve that operates on sound money principles and does not accommodate fiscal irresponsibility from the legislators. I prefer a Federal Reserve that is transparent – as opposed to one that obscures and confuses. I prefer a Federal Reserve that does not seek to control markets. I prefer a Federal Reserve that doesn’t create bubble after bubble after bubble.

Unfortunately, we don’t always get what we want or what I prefer.

At near zero interest rates and with an asset purchase program of $80 billion per month, the Federal Reserve has gotten its hands so deeply into our no-longer-free markets that they cannot pull them back out without risking a market collapse.

Even the hint of future interest rate increases or future tapering of asset purchases puts the Everything Bubble within a pinprick of catastrophe.

Even though they are out of ammunition – in my opinion – inexplicably, the world still hangs on their every word.

For now.

Secondly, despite a roughly 14% drop in a year or so, the world still considers the U.S. dollar to be strong.

Gold tends to benefit when there is a dip in U.S. dollar confidence. In such times, investors flock to the safe haven of gold to store their purchasing power.

Yet, despite the clear decline in the U.S. dollar, compared to the rest of the world’s fiat currencies, it remains the cleanest shirt in a hamper full of dirty laundry. It remains the best-looking horse in the glue factory.

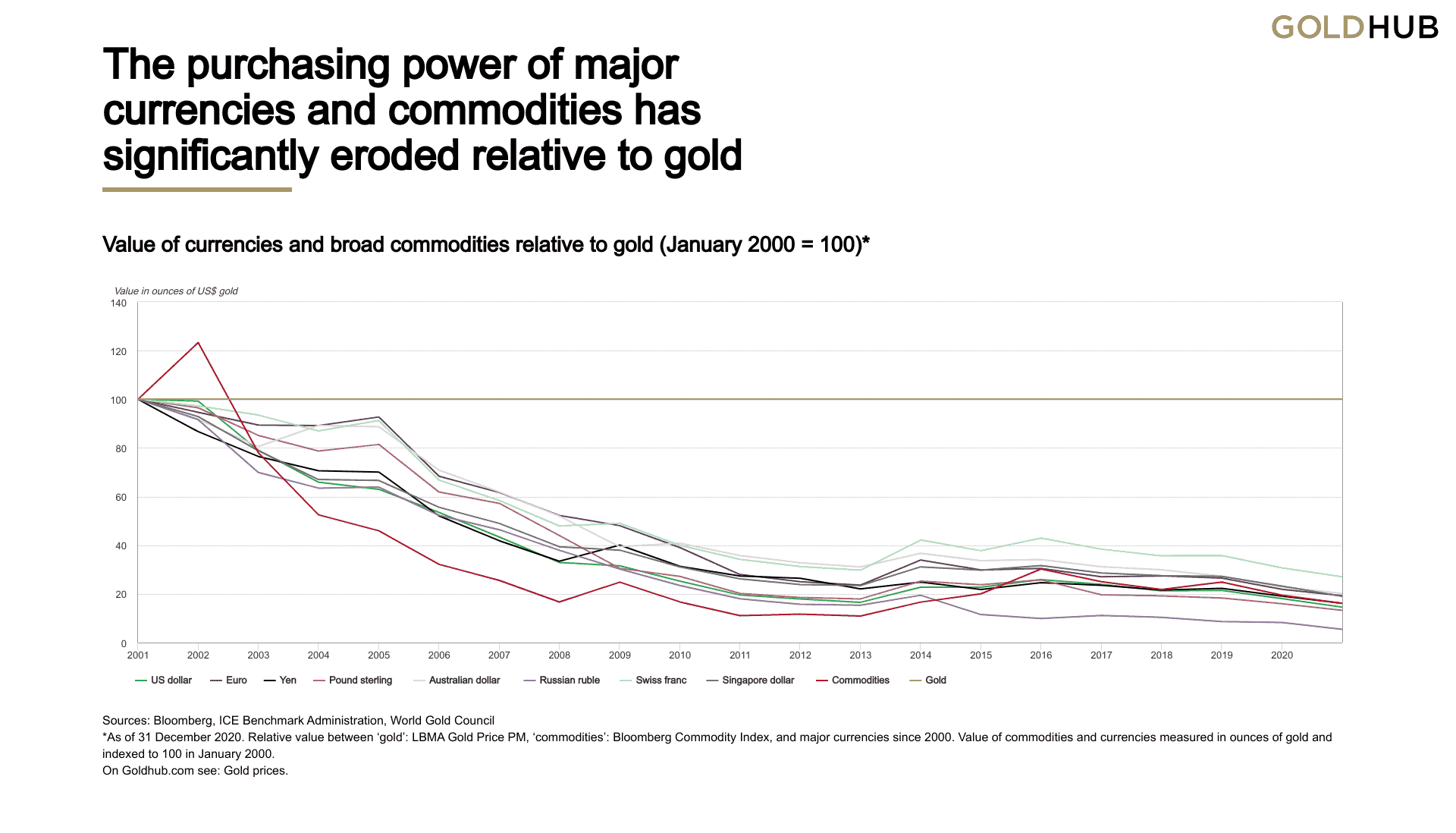

But, if you can look past the mediocrity of the U.S. dollar’s peers, you can see how woefully they have all performed compared to gold. This is very evident in the following chart courtesy of the World Gold Council…

As long as the Federal Reserve leaves the easy money punchbowl in place, investors will continue to party on. The Federal Reserve has created all these bubbles, and investors do not want to miss out on their fair share of profits.

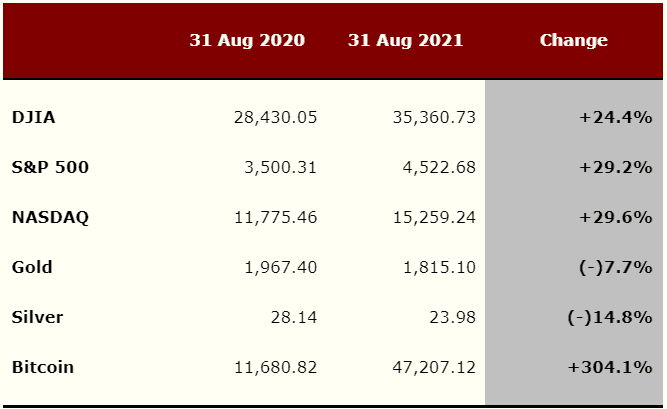

To date, FOMO has been a stronger force in the psyche of investors than the fear of the entire house of cards crumbling down. To me, this is the most significant headwind gold has faced to date.

Winds of Change

But I see change coming.

Since the last addition of Escape Artist Insider magazine, we’ve seen a change in our client behavior, especially over the past few weeks.

Now, keep in mind that retail demand has been very strong for the past two years, despite the frustration many have expressed in the lackadaisical gold price.

Here are some of the things we have noticed of late:

- Clients who haven’t bought gold in a decade are calling in to place orders.

- When we make outgoing calls to clients, fewer and fewer clients are saying, “Not now,” or

“I’m not ready.” More and more clients are saying, “I was just thinking about you, thanks for the call.”

- At conferences, the mood is turning much more anxious about the current situation.

- The size of client purchases is on the rise, with many of those transactions in the six or seven figure range.

In short, it has become obvious to me that FOMO is beginning to give way to fear about the current state of affairs. It is palpable. Investors are acting on fears they had been burying up until now.

This is just speculation, but the one catalyst for this change I can point to is the debacle in Afghanistan. Since this news began to break, the change in client behavior has become more apparent. It may have been the proverbial straw that broke the camel’s back.

It may finally be time for investors to bank their Everything Bubble profits to preserve their gains in history’s most reliable and constant store of purchasing power: Gold.

Keep Your Eye on the Prize

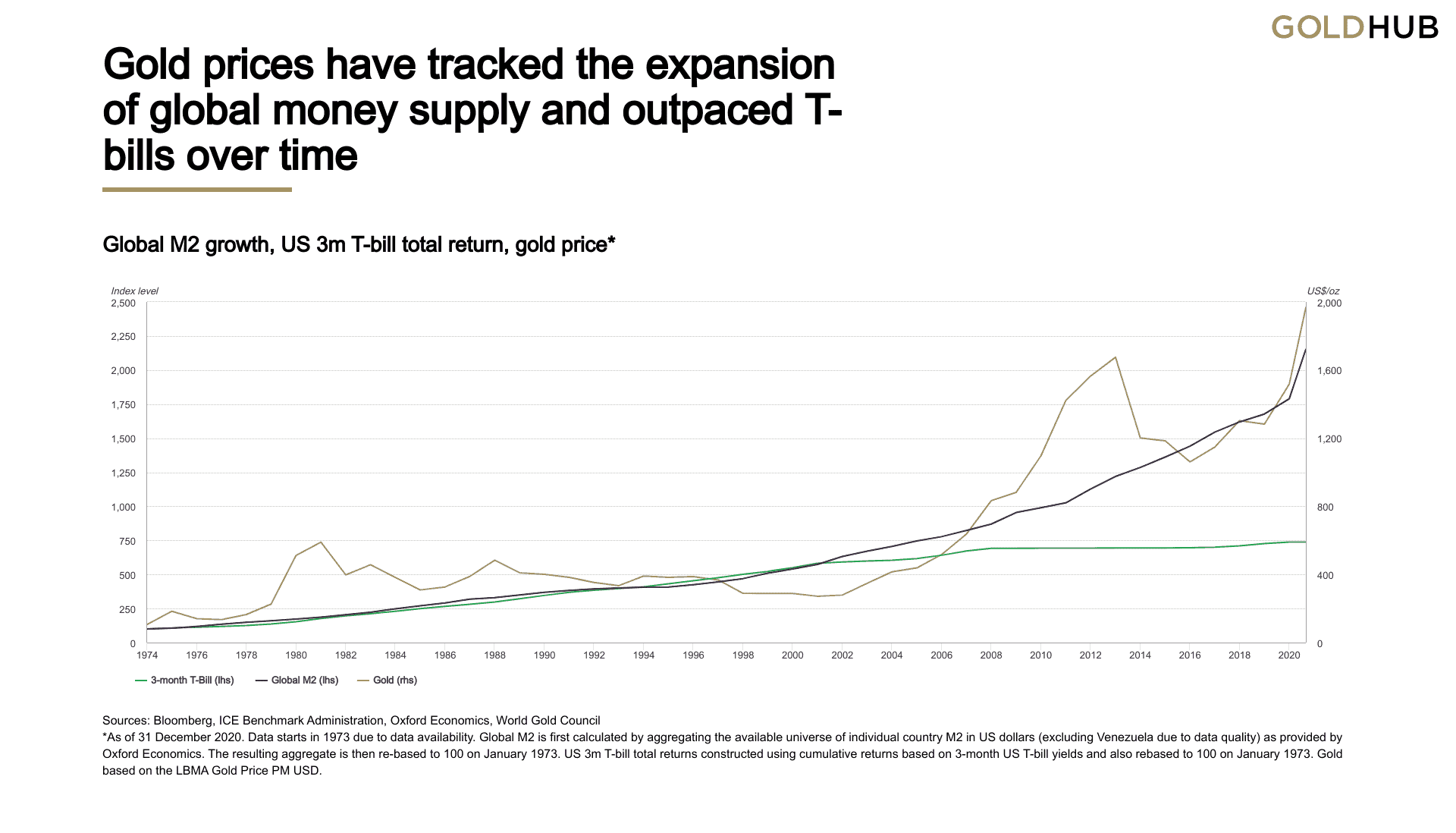

For those of you who want to Keep What’s Yours, I have one final chart to share with you, again courtesy of the World Gold Council.

Notice how well the gold price has tracked the money supply historically.

This makes perfect sense. When the amount of fiat currency in circulation is increased, the cost of all finite goods and services increases as well. As more fiat currency chases limited supply, that buying pressure results inevitably in higher prices.

Gold is one of the very best barometers we have of this phenomenon.

And, given the hyperbolic increases in fiat money supply all around the world, higher gold prices seem to me to be the best option for a “sure thing” that I can imagine.

If you want to hold onto what you have as a result of this Everything Bubble – in other words, if you want to Keep What’s Yours – your next move is an obvious one.

Got Gold?!?

Good investing!

Contact Author

"*" indicates required fields

Stay Ahead on Every Adventure!

Stay updated with the World News on Escape Artist. Get all the travel news, international destinations, expat living, moving abroad, Lifestyle Tips, and digital nomad opportunities. Your next journey starts here—don’t miss a moment! Subscribe Now!