Getting into Gold Part 3: Why is Gold Important Now?

This past year, the incredible bull run in stocks continued. The stock bull has been running for over a decade now – since the Financial Crisis of 2008-2009. And, until recently, the Dow, the S&P 500, and the Nasdaq were all making new all-time highs virtually every day. Those who have been invested in equities have done well.

If you missed Part 1 & 2 in this series, Getting into Gold Part 1: Why Should I Buy Gold? you can read it here and here Getting into Gold Part 2: How Do I Buy Gold?

So, you would probably guess that equities have been the best-performing assets of this century.

Not so fast…

Media Bias

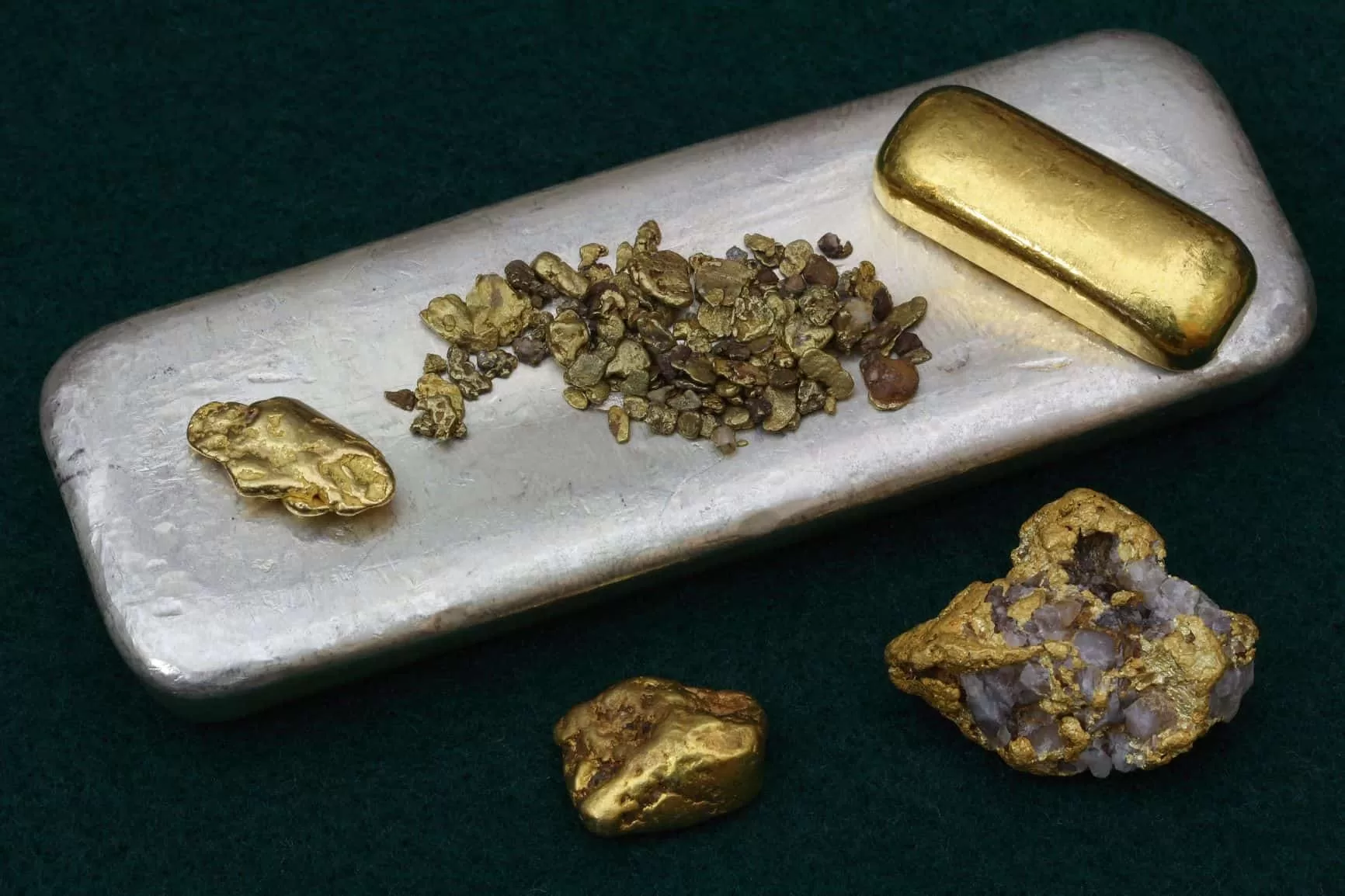

Gold and silver performed extremely well during their last 10-year bull market – gains of 650% for gold and 1,000% for silver. Most investors never saw returns like that with dividend stocks. Yet, when asked if they would consider adding a small allocation of gold and silver to their portfolio, most would say they had no interest in precious metals whatsoever.

Even introduced to staggering returns, they won’t consider it. Nowhere has the media bias in favor of traditional paper stocks and bonds been as evident as these conversations.

The media has effectively convinced investors that precious metals are risky, do not appreciate, and are way too complicated to even consider owning. Of course, banks and brokerages have paid the media well over the years, through lucrative ad campaigns, to get that message out.

Numbers Don’t Lie

Considering the effectiveness of the brain-washing, those ad campaigns may actually be the first documented instances of “fake news.”

When you look at the numbers, you get a slightly different picture.

| Jan 2001 | Jan 2012 | Jan 2016 | Jan 2020 | % Increase | |

| Gold | $253.00 | $1608.00 | $1,062.00 | $1,516.80 | 500 |

| Silver | $4.53 | $29.23 | $13.93 | $17.82 | 293 |

| Platinum | $610.00 | $1,435.00 | $895.00 | $964.00 | 58 |

| Palladium | $962.00 | $666.00 | $565.00 | $1,923.00 | 100 |

| DJIA | $11,533.20 | $12,294.00 | $17,425.03 | $28,583.44 | 148 |

| S&P 500 | $1,255.00 | $1,265.33 | $2,043.94 | $3,230.78 | 157 |

| Nasdaq | $2,667.61 | $2,618.64 | $5,007.41 | $8,972.60 | 236 |

Gold and silver effectively broke out to the upside in June of 2019. For many, that was the signal a new precious metals bull market had begun. Twice in 2020 so far, we’ve seen similar price surges.

However, you have to go back to December of 2015 to see the lows for both gold and silver following their correction from all-time highs achieved during their last bull market. Gold fell from $1,900 (September 2011) to $1,049.40. Silver fell from near $50 (April 2011) to $13.71.

Insurance Versus Profit

Since Michael Checkan and Glen O. Kirsch founded Asset Strategies International in 1982, ASI has been educating friends, families, clients — and anyone else who would listen — about gold. We view it as a long-term store of value that would protect their savings from inflation, the devaluation of the dollar, and a continuing increase in the money supply.

We have always sold gold and silver first and foremost as an insurance policy. It is a way to protect assets in a world of fiat currencies – the new international economic and monetary environment in which currencies are no longer backed by gold.

In such an environment, gold and silver are the only real money in existence.

We believe you should own gold and silver always as insurance. You buy it. You hold it. And, you never sell it, unless you have a financial crisis. We like 10% of investible assets for this allocation.

We also believe you should own gold, silver, platinum, and palladium sometimes for profit. These purchases are made after a precious metals bull market has been established. And, as the bull market progresses, dips in the price are your entry points, and short-term peaks are exit points when rebalancing. We favor an additional 10% to 15% allocation for this purpose.

No Cash Is No Excuse

Precious metals bull markets are some of the most lucrative markets historically. Duration tends to be about a decade. Appreciation tends to be significant.

If you do not have the cash to participate, I suggest you find some. Adjust your current allocation to make room for gold and silver. Take profits as you rebalance. Re-allocate funds if you get stopped out of positions.

Look to your IRA for available cash.

Being creative now in the early stages of this fledgling bull market for gold and silver will no doubt pay worthwhile “dividends” in the future.

To learn more about buying precious metals for protection and for profit, please call ASI at (800) 831-0007 or email us today. We stand ready to help you Keep What’s Yours!

If you missed Part 1 in this series, Getting into Gold Part 1: Why Should I Buy Gold? you can read it here along with Getting into Gold Part 2: How Do I Buy Gold?

About The Author

Rich Checkan, ASI President

As the President and COO of ASI, Rich has knowledge of every facet of ASI’s operations. He has been an integral part of ASI’s maturation from a precious metals and foreign exchange dealer to a full service tangible and rare tangible asset provider—to include rare U.S., world, and ancient coins. Rich oversees the operations, administrative, sales, and marketing departments, as well as serving as ASI’s Compliance Officer.

To contact Rich Checkan or anyone from his team, reach out to Asset Strategies International at 800-831-0007

Contact Author

"*" indicates required fields

Stay Ahead on Every Adventure!

Stay updated with the World News on Escape Artist. Get all the travel news, international destinations, expat living, moving abroad, Lifestyle Tips, and digital nomad opportunities. Your next journey starts here—don’t miss a moment! Subscribe Now!