In the United States and Canada, we are currently being taxed to death. With the recent announcements from both Trudeau and Biden about increasing the capital gains taxes to finance their massive, wasteful spending, many more people are finally hitting their breaking point.

They’ve even floated out the idea of taxing unrealized capital gains. WTF is wrong with these people????

Guys: The writing is on the wall. Our countries are traveling down a very dangerous path and, at this point, I’m not sure if these runaway trains can be stopped. With debt ceilings increasing drastically to pay for foreign wars, illegal immigrants, and overall systemic corruption, someone’s got to pay for it.

And, in the immortal words of Ernie from Sesame Street: “You’re it, Burt!”

As they say though, realizing you have a problem is the first step. And the fact that you are reading this and putting some thought into expatriating overseas puts you waaay ahead of most people in that regard.

So, let’s talk solutions, shall we? If you are looking to reduce your tax bill as part of your offshore planning, you are going to want to learn about territorial tax systems and how you can leverage them to reduce your taxes as part of your comprehensive plan.

Join me below to discuss what a territorial tax system is, how it can (potentially) help you significantly reduce your taxes, and some of the top countries in Latin America that boast this system.

What is a Territorial Tax System?

As per NASDAQ, a territorial tax system is tax system that taxes residents on domestic income but not foreign income.

This is in contrast with Canada, which taxes residents on worldwide income, and the United States, which taxes citizens on worldwide income.

For the most part we have tax treaties with other countries to avoid double-taxation, but the Canadian and U.S. governments will make sure you are taxed on all your worldwide income, one way or another.

How can a Territorial Tax System help reduce your taxes?

Just to be clear, this is not tax advice. If you want advice on your specific situation, you should reach out to an accountant and/or lawyer with experience in this area, such as our good friend and Escape Artist Insiders magazine contributor Joel Nagel. He is an expert in offshore planning and can help you build a plan to suit your needs.

Territorial tax systems are attractive to people looking to reduce their tax burden because, by becoming a tax-resident in a country with territorial tax, you will not be taxed on any income you make outside that country. Assuming most of your income is coming from Canada or the United States, this could massively reduce your taxes if you implement it properly.

There are two key components to reducing your taxes with a territorial tax system. First, you will need to become a tax resident of a country with a territorial tax system. Second, you will need to become a non-tax resident in your home country.

To become a tax resident in a country with a territorial tax system, you will need to check the requirements for the specific country you have your eye on. Check out my list of countries below for a brief description on how to achieve tax residency in each one!

When it comes to becoming a tax non-resident in your home country, with residential tax systems like Canada’s, the general rule of thumb is that you need to spend at least 183 days outside the country in a given calendar year PLUS have no residential ties to the country to become a non-tax resident. It can be a rigorous process, but it is possible.

It’s harder for Americans to do this due to their citizenship-based tax system. Leveraging the foreign-earned income exclusion is a great tool to take advantage of if you make money outside the U.S., but I’d highly recommend consulting with someone like Joel if you are looking at ways to reduce your tax bill as an American. It is definitely possible, it’s just a little more complex and, thus, requires more planning.

Top 5 Countries with Territorial Tax Systems in Latin America

Central and South America provide a ton of options for affordable residencies that come with the benefit of territorial tax systems. Check out the countries below for affordable, attainable options to reduce your cost of living, improve your quality of life, and reduce your tax burden.

1. Panama

You knew we had to kick off the list with perennial expat favorite, Panama! Panama has a ton of residency options available for retirees, digital nomads, investors, and pretty much everything in between. Plus, it offers phenomenal benefits for retirees.

How to become a tax resident: Spend over 183 days in the country in one calendar year. Other factors such as properties owned may also affect your tax residency status.

Currency: USD ($)

- Retirement/Pensionado Visa

- Friendly Nations Visa

- Reforestation Visa

- Investor Visa

Personal tax rates for income earned in Panama: Ranges from 0 – 25% based on income.

Corporate tax rate for income earned in Panama: Flat rate of 25%.

2. Nicaragua

Nicaragua is a popular destination for North Americans and Europeans, with a large cohort of Canadians choosing this beautiful country as their offshore destination of choice. Increasing infrastructure investment is helping Nicaragua to become even more accessible, making it an increasingly popular destination.

Currency: Nicaraguan Córdobas (C$)

How to become a tax resident: Spend over 180 days in the country in one calendar year.

- Pensionado Visa

- Rentista Visa

- Investor Visa

Tax rates for income earned in Nicaragua: Ranges from 0 – 30% based on income.

Corporate tax rate for income earned in Nicaragua: Flat rate of 30%.

3. Belize

This English-speaking country is garnering more and more attention from North Americans. With a very well-established financial sector, Belize is a great place to check out as a potential tax haven.

Currency: Belize Dollar (BZ)

How to become a tax resident: Spend over 183 days in the country in one calendar year.

- Qualified Retired Program (QRP) Visa

- Long Stay/Digital Nomad Visa

Tax rates for income earned in Belize: Flat rate of 25% on income over $26,000 BZ.

Corporate tax rate for income earned in Belize: Flat rate of 25%.

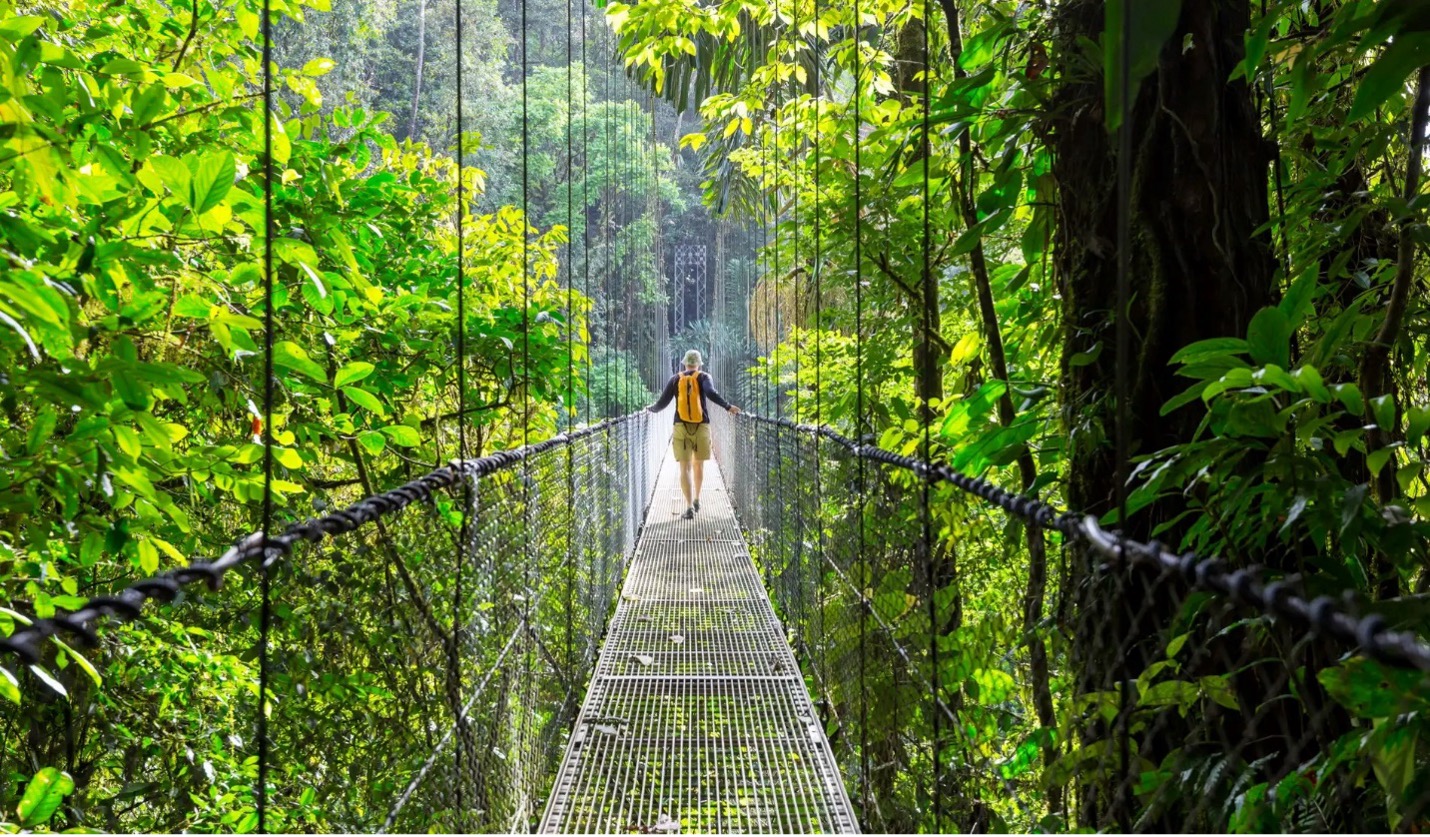

4. Costa Rica

Come for the sun and surf, stay for the reduced taxes! Costa Rica has been a popular destination for expats for decades thanks to its natural beauty and pura vida lifestyle.

Currency: Costa Rican Colón (CRC)

How to become a tax resident: Spend over 183 days in the country in one calendar year.

- Qualified Retired Program (QRP) Visa

- Long Stay/Digital Nomad Visa

Tax rates for income earned in Costa Rica: Ranges from 0 – 25% based on income.

Corporate tax rate for income earned in Costa Rica: Flat rate of 30% for companies with income over CRC 122,145,000.

5. Paraguay

Paraguay? Where’s Paraguay? Nestled between Argentina, Brazil and Bolivia, this South American country is starting to get on more people’s radars thanks to its simple, affordable residency programs and economic strength.

Currency: Paraguayan Guarani (PYG)

How to become a tax resident: Acquire your temporary residency and then get your Tax ID.

Residency programs:

- Temporary residency

Tax rates for income earned in Paraguay: Ranges from 0 – 8% based on income.

Corporate tax rate for income earned in Paraguay: Flat rate of 10%.

Will you incorporate a Territorial Tax Country into your Plan B?

As you put together your Plan B or debate where you want to spend your retirement years, you are going to want to take into account both where you enjoy spending your time and where your dollars can stretch the furthest.

Stretching your dollars means both lowering your everyday cost of living and reducing your tax burden, too.

Countries with territorial tax systems are a great tool you can leverage to escape the Canadian and American tax nets, or at least reduce your exposure. There are definitely some hoops to jump through and some requirements you will have to meet but, with the right planning, you will be able to drastically reduce your taxes.

Take back control of your future by keeping more of your own money. I think we can all say with certainty that our money is better spent and invested by us than our wasteful governments, wouldn’t you agree?

All of us here at Escape Artist want nothing but success for you in your Plan B journey. That’s why we put together this month’s issue of Escape Artist Insiders magazine, which is focused on overseas property investments – one of the topics our readers are most interested in, myself included!

If you are building your Plan B or just want to learn a little more about offshore planning, this is a key issue you won’t want to miss. Subscribe today!

Thanks for reading and have a great week!

Contact Author

"*" indicates required fields

Stay Ahead on Every Adventure!

Stay updated with the World News on Escape Artist. Get all the travel news, international destinations, expat living, moving abroad, Lifestyle Tips, and digital nomad opportunities. Your next journey starts here—don’t miss a moment! Subscribe Now!