Best Reasons to Set Up a Self-Directed IRA

Best Reasons to Set Up a Self-Directed IRA

The Top Five reasons people set up an international self-directed IRA are:

- You want the freedom to take control of your investments.

- You want to globally diversify your investment portfolio.

- You want to own the best foreign investments, hard assets especially, to maximize returns on your retirement account.

- You want to become your own investment advisor and search out unique and high-return investments earning more than a boring U.S. index fund can offer.

- You want to protect your retirement savings by moving it out of the United States and by diversifying out of the U.S. dollar.

These are all good reasons to read on and see what you can do to globalize your IRA. But more importantly, there’s a reason to do something right now.

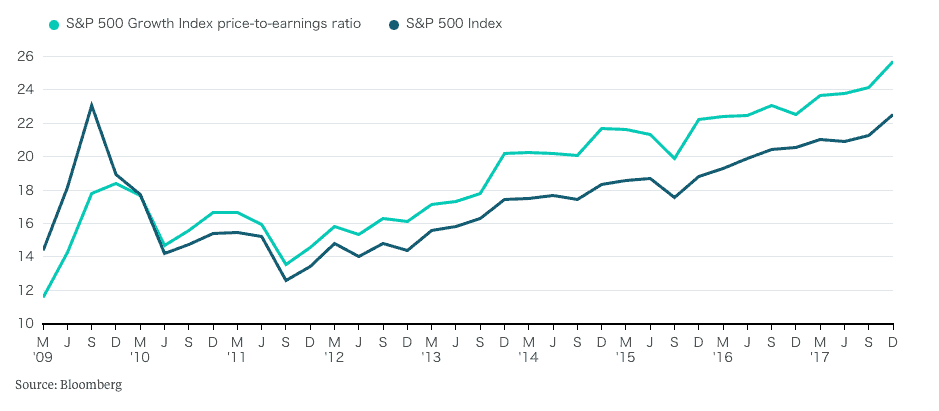

For example, some analysts are saying that stocks have hit dangerous PE Ratios. The Bull Market has seen its longest run ever. See the climb since 2009? They’ve nearly doubled. Does anyone really think that the companies are going to produce nearly twice the profits to drive a yield to investors now over 9 years ago?

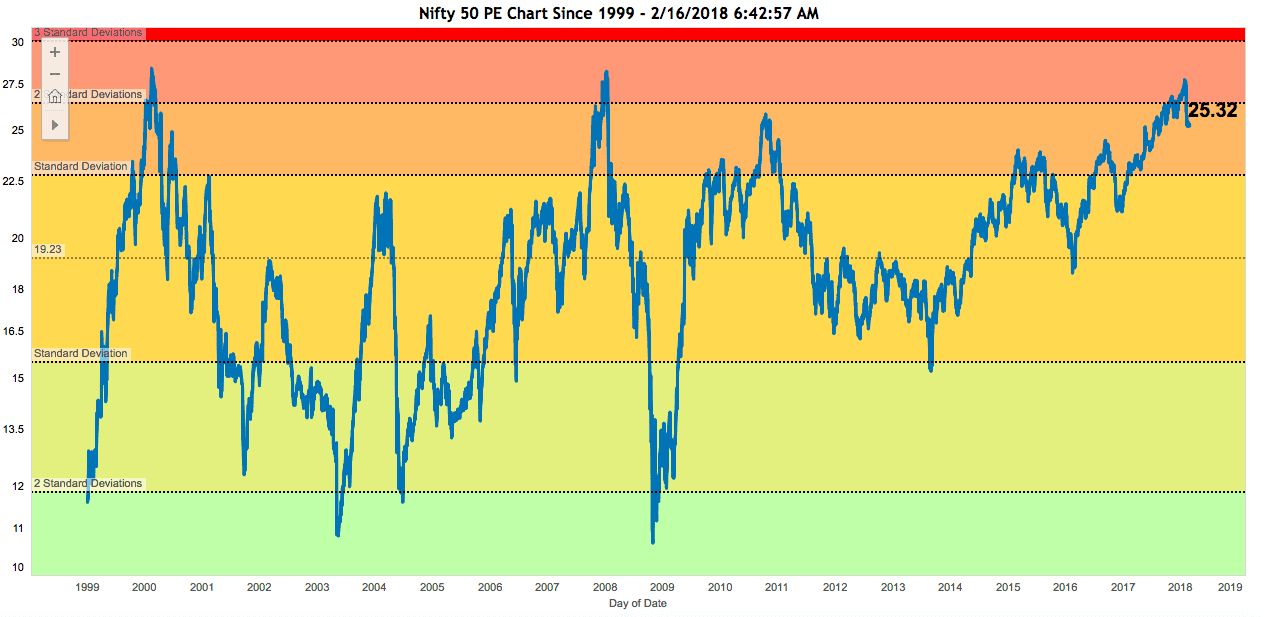

Then, to see the impact of the cycle on the market, check out the market since 1999 in the next chart. While the chart above looks great from 2011 on, when seen as part of a longer timeframe, something else appears. Each time the PE ratio hits this level, it has fallen back substantially. It must, because the stock price to earnings ratio is a great way to measure value. When a stock trades at 20 times earnings, the gross possible yield to investors is under 5%. The gross possible yield. Not the actual yield.

So, see the 4 crashes in the last 20 years that dip into the green? Another one is coming. It has to. Markets cycle.

So, see the 4 crashes in the last 20 years that dip into the green? Another one is coming. It has to. Markets cycle.

Do you want to ride the prices down? Of course, it’s impossible to time the markets, but playing the odds is smart. Taking money off the table when you have a huge gain is simply wise and prudent. But then what to do with it?

It’s always better to have some eggs in different baskets as the saying goes, isn’t it? Global diversification is easy to do. It just requires a little bit of outside-the-masses thinking. Remember: There’s no competition outside the masses.

One place that many people have significant investment capital currently tied up in the markets are IRAs. These are great vehicles for tax deferral, but because of the high degree of regulation, they require a custodian. Most people use a large brokerage like Schwab, Fidelity, or another market-maker firm. While permitted by law to let you “self-direct,” most won’t. They want you tied into their funds and their trading systems so that they receive the fees and commissions associated with your account.

In order to take control over your retirement account, you must first set up a self-directed IRA with a custodian who will allow you to do what you are permitted under the law. Invest your funds globally outside the traditional markets. This account must still be with a U.S. custodian, but now with one experienced in offshore transactions. There are many such firms out there, and some are better than others, of course.

I personally use NuView out of Orlando, Florida, for my family’s IRAs and have been very happy and satisfied with their service and fee structure. While many firms offer self-directed accounts, very few understand and allow you to hold international assets. NuView does. You can get more information here.

For most people, setting up a self-directed account simply means moving from your traditional custodian to one that allows for foreign investments. For active traders, or people who desire to hold multiple investments inside their IRA, this can also mean forming an offshore IRA LLC. The LLC becomes the owner of the assets, and your IRA owns the LLC.

The most popular foreign investment for self-directed IRAs in 2018 has been international real estate. In this category, our clients tend to focus on condominiums and single-family homes which they plan to rent out. Remember, the property you own inside an IRA must be 100% investment. Any personal use is forbidden by law.

Income-generating oceanfront condos on a world-famous surf break.

Income-generating oceanfront condos on a world-famous surf break.

Yes, an IRA can legally own real estate and a lot of other alternative investments. Other top investments for self-directed accounts include private equity, promissory notes, physical gold, oil and gas, and timber. Note, however, that your IRA can’t own insurance, collectibles, or stock in S corporations.

Let’s Talk Taxes and Your SD-IRA

How you invest with an IRA is very different overseas from domestic investments for a couple of reasons. One is taxation, and specifically capital gains.

The way to find the best foreign investments for your self-directed IRA in real estate is to balance expected returns (rental income and appreciation) with the capital gains tax you will pay in the country.

When you buy real estate abroad with your personal savings (after tax money and not an IRA account), you should look for properties in countries with a capital gains rate of 20% or less. That’s because you’ll pay a minimum of 20% on long-term gains no matter where you live and no matter where the property is located.

This is because U.S. citizens are taxed on our worldwide income. When you sell a foreign property, you’ll pay the U.S. long-term rate of 20% to the IRS. Then you get a dollar-for-dollar credit for any foreign taxes paid.

This means that the lowest capital gains rate you’ll pay on the sale of foreign real estate is 20%.

For example, Colombia has a capital gains rate of 10%. If you sell a property in Colombia that you’ve held for at least 2 years, you’ll pay 10% to Colombia. Then, when you file your U.S. return, you’ll report the gain and use the Foreign Tax Credit to get a credit for the 10% paid to Colombia. The result is that you’ll pay 10% to the IRS (20% U.S. rate minus the 10% paid to Colombia, for a total global tax rate of 20%).

The capital gains tax rate in Australia is 27%. So, when you sell a property there, you’ll pay 27% to Australia and nothing to the IRS. The Foreign Tax Credit will have wiped out your U.S. tax obligation.

So, again, when investing non-IRA funds, you want to look for countries with a capital gains rate equal to or lower than the US rate. The list of countries with capital gains rates of 20% or less is quite significant. See: Capital Gains Tax by Country.

Because you pay zero U.S. tax on money deposited into your retirement account, and assuming returns are equal between countries, the best foreign real estate investments for your self-directed IRA will be in countries with a zero capital gains rate. That is to say, any capital gains tax paid will reduce your net returns and won’t give you a corresponding U.S. tax credit… so, it’s money wasted.

The most popular countries with zero capital gains tax include New Zealand, Hong Kong (zero if held for at least 36 months), and Belize. For a country seeing a rapid maturation of the tourism industry, check out Belize. You can email me to get a copy of the most recent white-paper discussing how this rapid growth is outpacing supply and where investment opportunities reside for globally minded investors.

The Belize Marriott Residences Ambergris Caye Resort, coming soon – find out more right now.

The Belize Marriott Residences Ambergris Caye Resort, coming soon – find out more right now.

Another best foreign investment with a self-directed IRA is in Teak Timber. In Panama, for instance, your retirement account can buy $20,000 in an approved teak plantation. Panama even has a 2nd residency program with a path to citizenship in 5 years. You’ll need to pay residency fees from your personal account. You can’t receive an indirect benefit from your retirement account, thus, you need to cover some expenses from your savings.

This program is only available to US citizens and citizens of the “50 friendly nations.” For a list of those countries, and more information on this program, see: How to get Residency in Panama Using Your IRA.

Baby teak and 20-year-old teak, the ultimate hard asset investment for an IRA.

Baby teak and 20-year-old teak, the ultimate hard asset investment for an IRA.

Then there are clients that want to trade their own accounts or invest in cryptocurrencies. These active traders need to form an offshore IRA LLC in addition to moving their accounts to a self-directed custodian that allows for international investments. Because this adds about $3,500 to your startup costs, you should be committed to these investments before moving forward.

I hope you’ve found this article on the best foreign investments for your self-directed IRAs to be helpful. For more information, feel free to contact me or reach out directly to NuView if you’d like.

By the way, Glen Mather, the owner of NuView is a real top-notch guy. He has been working with the Wheelchair Foundation for years and recently pulled me in, too. We delivered over 400 wheelchairs to Nicaragua so far and are working on a container of 280 chairs to Belize in 2019. Each chair is $150 and changes a life forever.

ECI Development, NuView IRA, Chair the Love, and Managua-Tiscapa Rotary on delivery.

ECI Development, NuView IRA, Chair the Love, and Managua-Tiscapa Rotary on delivery.

If you live in Central Florida, Glen is having an event in Orlando on Friday, September 7th. This is the annual Chair the Love Fundraiser and I’ll be there, too. Hope to see you.

Here is probably the most extensive ebook on Everything You Ever Wanted To Know About Eliminating Your Taxes, Protecting Your Assets And Regaining Privacy Over Your Life And Investments. It is called The Ultimate Guide To Going Offshore.

Michael K. Cobb is the CEO and co-founder of ECI Developments which has properties throughout Latin America. He speaks all over the world on international real estate and is a board member of the National Association of Realtors.

Michael K. Cobb is the CEO and co-founder of ECI Developments which has properties throughout Latin America. He speaks all over the world on international real estate and is a board member of the National Association of Realtors.

Like Our Articles?

Then make sure to check out our Bookstore... we have titles packed full of premium offshore intel. Instant Download - Print off for your private library before the government demands we take these down!