In this post, we’ll look at the new tax shelter signed by President Trump a few days ago – the opportunity zones. These opportunity zones might be the biggest tax shelter every in the United States. Opportunity zones are incredible opportunities for those who wish to shelter capital gains.

In 2017 a tax overhaul bill was passed making a great deal of changes to the tax treatment of real estate, no surprise when you think about the real estate fortune that current President Donald Trump has amassed.

Included in that bill was the Investing in Opportunity Act. The Investing in Opportunity Act established new opportunity zone programs that consisted on opportunity zones and funds. These zones are found in every US state and the US territory of Puerto Rico (98% of this island is an opportunity zone).

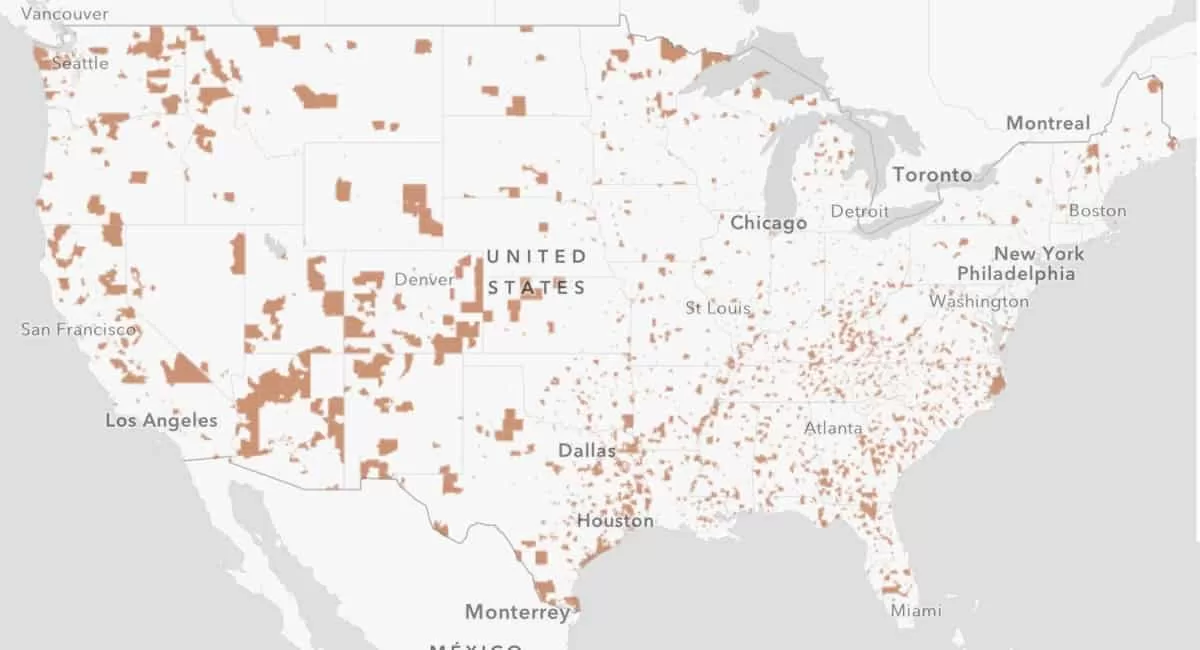

If you are thinking that you live in a state where everything is fine and there are no zones that desperately need investment click here: Opportunity Zones Map. You’ll find a map with a list of all the opportunity zones that exist in America.

I was surprised when I found out that Logan Heights, a neighborhood in the prosperous city of San Diego (my home town) was featured on the list. There are some states that have more than some, but every state has at least a few opportunity zones. The highest concentration is in Puerto Rico.

The main goal of the Investing in Opportunity Act is to promote investment in these opportunity zones. The goal is for the investment to be private rather than by taxes or direct government funding. It’s the use of pre-tax money creating an amazing tax-free or tax-deferred shelter for your realized capital gains.

That is to say, the way in which they are promoting this is by giving the private investor capital gains tax incentives that are available exclusively through stipulations made by the Investing in Opportunity Act.

Before the tax overhaul bill was passed there was little to no attention made to promote investment into these areas, making investors feel unfamiliar and unsafe about investing in these parts of town. The goal is to change their minds.

A neighborhood or district can be deemed an opportunity zone when they meet the low income qualifications to be registered as one, territories and districts with fewer than 100 census tracts, and other territories that meet other geographic and income requirements.

Once an area is selected as an opportunity zone it stays that way for at least 10 years, the qualification disappears if a good amount of investment is made in the area. As of the writing of this article more than 8,700 opportunity zones exist in the United States.

You read that right, the United States a country with one of the highest cost of education and cost of living has more than 8,700 opportunity zones. The problem is that the media spotlights big and thriving cities and completely forgets about small town America or surrounding areas that are being affected by the high cost of living and low wages.

When the tax overhaul bill was done, it was the job of your governor and district council to make sure that your area could qualify as an opportunity zone. If you are living in an opportunity zone and don’t see your district on the list I highly recommend you call your senator to begin the process as I believe investment will soar in these areas.

With the list featuring all of the Opportunity Zones in the United States these private investors have a reference point that includes where they can invest in communities that will welcome their business projects with open hands.

The Investing in Opportunity Act is shaping up to be one of the major accomplishments by the Trump Administration as almost every legislator supported the bill and had high hopes for its fruition. It might turn out to be the biggest tax holiday in the history of the United States.

Other government programs designated to incentivize private investments have the disadvantage that there is a lot of government interference, the Investing in Opportunity Act gives the private investors more freedom to realize their projects.

Because the opportunity zones are known to have a low cost of rent for businesses and real estate development the investment is much less costly than what you would expect, making it less costly and less restrictive than any other investment program on the market.

It would be wise to look at opportunity zones if you are looking to invest in the United States, you can avoid the fierce competition of investing in big cities, while also creating jobs and pouring money into communities that need it.

I hope you’ve found this article on Opportunity Zones to be helpful. For more information, or for assistance in investing in an Opportunity Zone, please contact us below by filling out the form, Thank you.

Oops! We could not locate your form.

Contact Author

"*" indicates required fields

Stay Ahead on Every Adventure!

Stay updated with the World News on Escape Artist. Get all the travel news, international destinations, expat living, moving abroad, Lifestyle Tips, and digital nomad opportunities. Your next journey starts here—don’t miss a moment! Subscribe Now!