When you’re living abroad and married to a foreign spouse, your US filing status can be confusing. I’ve heard preparers give all kinds of opinions on the tax filing status of those with a foreign spouse… most of them wrong. Here are your correct filing status options when you have a foreign spouse.

This article is intended for US citizens living abroad and married to a foreign person. That is, you and your spouse are living outside of the US and your spouse is not a US citizen, green card holder or resident. They are a nonresident alien according to IRS lingo.

Once your spouse has his or her green card, they’re a US person for tax purposes. Their worldwide income becomes taxable by Uncle Sam and your tax planning options are greatly reduced. For this reason, most expats wish to maintain the nonresident status of their spouse, especially entrepreneurs and business owners.

I generally recommend those with international tax considerations, as well as those qualifying for the FEIE using the physical presence test and business owners, file separately whenever possible.

This is to eliminate the risk of a tax debt moving from the business operator to the innocent spouse. Such planning can save you a lot of cash… and possibly your marriage. For more, see: Expat Entrepreneurs Should File Separately.

With that said, let’s get back to how to determine the US tax filing status for those with a foreign spouse.

When you’re married to a foreign national you have the option to file jointly (don’t do it!) or married filing separately.

If your nonresident alien spouse agrees, and elects to be treated as a US resident for tax purposes, you can file jointly.

Being treated as a resident for US tax purposes means that your spouse is taxed on his or her worldwide income. It also means that they should report their foreign assets, foreign bank accounts, foreign corporations, and international investments.

Filing jointly with your foreign spouse eliminates any privacy and asset protection you had when it comes to assets held solely in their name. They now have all of the tax requirements of a US citizen without the benefit of services or living in the United States.

In most cases, a US citizen married to a nonresident alien should be filing as married filing separately. You are legally married because you were married abroad. But, your spouse is not a resident of the US, thus you can’t file jointly (unless you are both treated as US residents for tax purposes).

It’s rare for the US citizen to be able to claim head of household for the added tax deduction. I also note that Trump plans to eliminate the head of household election, so this might not be an issue in 2018.

The most common way for the US spouse to take the head of household election is if you’ve been separated from your spouse for the last 6 months of the calendar year, you paid more than half of the cost of maintaining the home, and your dependent child lived with you for more than half of the year.

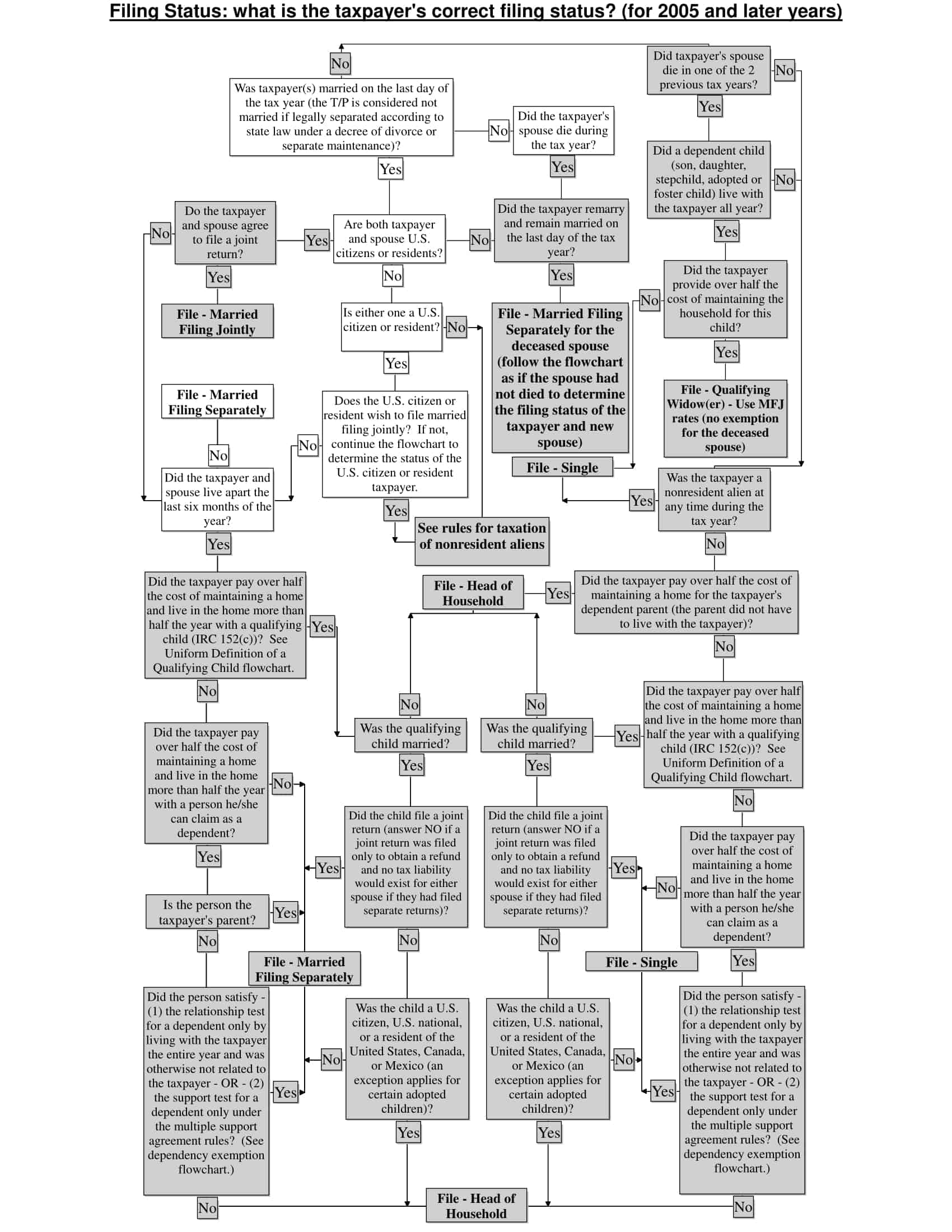

For other options and rules around selecting your filing status with a foreign nonresident alien spouse, see the chart below.

For assistance preparing your US international returns, please contact us at info@premieroffshore.com or call us at (619) 550-2743. All consultations are free and confidential.

Contact Author

"*" indicates required fields

Stay Ahead on Every Adventure!

Stay updated with the World News on Escape Artist. Get all the travel news, international destinations, expat living, moving abroad, Lifestyle Tips, and digital nomad opportunities. Your next journey starts here—don’t miss a moment! Subscribe Now!