Here at Escape Artist we know the importance of safety while travelling. Part of the safety aspect is having adequate health and travel insurance in case something goes wrong. Because it will. We partner with SafetyWing, the travel medical insurance made by nomads for nomads. Even if you are not a nomad, you can use SafetyWing for your travels.

But how do you choose an insurance? Is the company reputable? What do you do in case of an emergency while travelling abroad? Are sports and scuba diving covered? What about cancellation of the policy? Is it hard to make a claim?

I know… you have so many questions…

Let’s get started.

What do I do in an emergency?

Call local emergency services or go to your nearest hospital.

For 24/7 assistance, reach out to SafetyWing’s emergency response team OnCall International. You will need to give your name, policy ID, date of birth, contact information, arrival date in your current country, current location, and information about your situation.

How are medical bills paid?

For most expenses, you will pay for treatment and then make a claim for reimbursement.

If you are admitted to the hospital or need surgery, you can contact SafetyWing’s 24/7 response team, OnCall International, regarding direct billing.

Can I cancel my policy?

If you cancel before your policy starts, you get a full refund. If you cancel after your policy has started, then SafetyWing will refund anything apart from the first five days (as they have a minimum five-day policy purchase).

Experience the Insider community that takes your international lifestyle to the next level. Download your FREE guide

"18 Steps to Implementing Your Plan B" instantly!

How do I use my SafetyWing insurance for medical visits?

For treatment within the U.S., most medical providers will bill insurance directly.

For treatment outside the U.S. most expenses, you will pay upfront and then make a claim for reimbursement.

If you are admitted to the hospital or need surgery for a covered condition, you can contact SafetyWing’s 24/7 response team regarding direct payment.

How can I submit a claim?

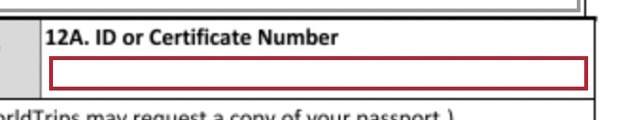

You can start your claim process by filling out the claimant’s statement with relevant information and bank details.

Make sure to note your current policy ID here:

Will I receive a confirmation email?

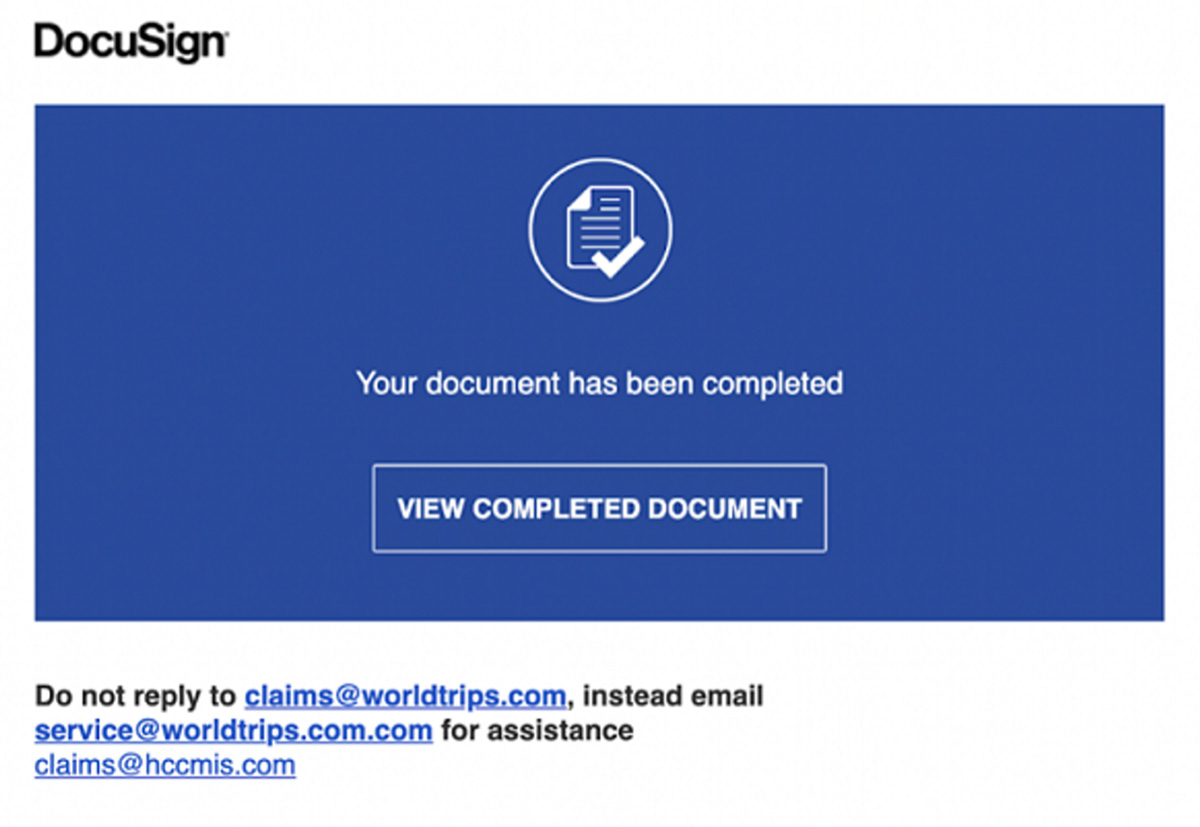

When you filled out the DocuSign claim form, you should’ve received an automated email like this (please make sure to check your spam inbox also):

This is the confirmation email that your claim form was successfully submitted. If you received the automated confirmation mail this means that SafetyWing’s insurer WorldTrips has your claim, and they are working on processing it.

Also, please make sure that the claim form which you’ve filled out is available at the bottom of the confirmation email referenced above. When you open it, the supporting documents that you attached when filing the claim should be at the end of the claim form.

How long does my claim take until it is assessed?

If you received the automated confirmation mail this means that SafetyWing’s insurer WorldTrips has your claim, and they are working on processing it.

Please note that claims can take 30 to 45 business days to process. If after 45 business days you still have no news, then please reach out to SafetyWing’s Customer Service and they will have their Claims Assistance team follow this up for you.

If you are using the Client Zone for the first time, you will need to create an account using your policy ID and the email registered to your account.

What is covered under COVID-19 Benefits?

Nomad Insurance provides coverage for COVID-19, the same as any other illness. If it was not contracted before your coverage start date and does not fall within any other policy exclusion or limitation.

The maximum coverage for COVID-19 is the same as the policy maximum, which would be USD$250,000 for ages 64 and below or USD$100,000 for ages 65-69.

Testing for COVID-19 (PCR test) will only be covered if medically necessary and ordered by a physician. The antibody test is not covered, as this is not medically necessary.

How does the deductible work?

The deductible is the specified amount of money you must pay for eligible medical expenses before the insurance will start to reimburse for these services.

In SafetyWing’s case, the deductible is USD$250 per certificate period (meaning the start and end date of your policy) and it applies to all medical expenses except for Emergency Dental and Emergency Eye Exams.

Your deductible will start at USD$250.

If you go to the hospital and your medical bill is USD$150, you will have to pay first, file a claim, and if your claim is approved it will reduce your deductible to USD$100.

If you go to the hospital again and your medical bill is $170 this time, you will need to pay first and file a claim. If your claim is approved the first USD$100 will reduce your deductible to $0, and the last USD$70 will be reimbursed.

Now that you have reached your deductible, for all future claims you will be reimbursed if your claim is approved.

How do I define my home country?

Home country is where someone principally resides and receives regular mail. Also, it is the country where you would return once done travelling. It is also the country where you would be evacuated medically or politically, or you would return in case of trip interruption or repatriation. You can pick whatever you feel fits this description best.

Is Scuba diving covered?

You can be covered for scuba diving if you are PADI/NAUI/SSI certified, or if you are not certified you are covered for up to 10 metres when accompanied by a certified instructor.

Nomad Insurance does not cover search and rescue as well as transportation from a dive site to a medical facility. A good tip to investigate if you are mostly interested in scuba coverage would be DAN, Divers Alert Network.

Sports and Activities

Nomad Insurance does provide coverage for sports and activities. You would only be eligible for coverage if you are in an amateur setting, meaning you can’t get any wage or reward from it. You would also need to ensure the activity is adequately supervised and appropriate safety equipment is always worn. Coverage is for recreational purposes incidental to a trip.

The Verdict

After reading the FAQ and you want to learn more or register for an account, go here. Not ready to travel just yet? No problem. You can register for an account now and start payments later when you are ready to go.

Charlotte Tweed is an adventurous soul with a goal to take you on a journey where you don’t just visit—you live it. Graduating with a Travel and Tourism Honours diploma, Charlotte began her expat journey on June 15, 2021. After travelling through multiple countries, Charlotte now calls Mexico home. Reading, writing, and researching the best expat destinations in the world are how she fills her days. As a published author, her mission is to transform your life with expat travel—one destination, one adventure, one story at a time.

Charlotte Tweed is an adventurous soul with a goal to take you on a journey where you don’t just visit—you live it. Graduating with a Travel and Tourism Honours diploma, Charlotte began her expat journey on June 15, 2021. After travelling through multiple countries, Charlotte now calls Mexico home. Reading, writing, and researching the best expat destinations in the world are how she fills her days. As a published author, her mission is to transform your life with expat travel—one destination, one adventure, one story at a time.

Like Our Articles?

Then make sure to check out our Bookstore... we have titles packed full of premium offshore intel. Instant Download - Print off for your private library before the government demands we take these down!