The Dow Jones Industrial Average just recently set an all-time high of 22,179. At the time of writing this, the index is sitting at 21,703. Are we all in? Are we riding the wave? Are we doubling down to get even more return? Are the shoe shine boys giving stock tips again?

Maybe we should remember the lessons of 2007-2008. Stock markets cycle. All markets cycle, up and down. How do we compensate for the inherent roller-coaster nature of this beast? We need to, right? The simple answer is diversification.

Why diversify? The math on investment gain and loss is punishingly simple. If you have a portfolio worth $100,000 and you lose $50,000, then you have $50,000 left. Now you must double your money with a 100% gain to get back to the $100k you had previously. Ouch. Once back to “even,” only then are the profits from that point forward true gain.

Have you doubled your money since 2008? Some folks have. But many haven’t from what I hear at conferences where I get to talk with folks from all over the U.S. and Canada. Sure, the banks and brokerage houses are doing well. The house always does well, doesn’t it?

But stepping back for a minute and viewing investments from a bigger picture, doing well financially means being successful no matter what the stock markets are doing. For example, I was invited to attend an exclusive forum for wealthy, sophisticated investors recently and had an incredible experience. Most of these people made serious money in the last decade, even with the down cycle. It was clearly obvious that these people knew something the average investor didn’t.

What was it? What allows these select folks to capitalize on tremendous opportunities and make the big bucks, while the majority of stock investors just do “OK” …. or worse? How are these few people making money hand-over-fist while 90% of the American public is just now getting back to even in their portfolios? Their success boils down to 3 major differences.

First, these elite in the investment world understand that true asset class, country, and sector diversification is the key to their financial success. Second, they never, ever let other people do their thinking for them. Third, and most importantly, they understand that perceived risk is not real risk. There is a “gap” between what feels like risk and actual risk. They know that in that gap there is profit. Huge profit. These elite investors can “see the gap.” More importantly, they possess the courage to charge through it.

A great example of this was a friend of mine, Ron Zent. He was a developer in Belize and, 45 years ago, he purchased 14,000 of acres in Belize for not much more than a song. It was just one of the many things he was doing with his money at the time, along with developing real estate in Texas. He tells me that his friends in Houston laughed at him and thought he was crazy. “Belize, where is that? Central America. Are you crazy? You’re going to get killed.”

Part of Ron’s massive holdings in Belize

Ron saw the gap between perceived risk and actual risk. He didn’t care what his friends said. He just simply charged through the gap and made a fortune. Sadly, Ron passed away in 2015 from old-age, so it wasn’t Belize that killed him despite his friends misgivings. When he was alive and kicking, Ron was over $20,000,000 richer for his wise decision to diversify his holdings back in the day.

Experience the Insider community that takes your international lifestyle to the next level. Download your FREE guide

"18 Steps to Implementing Your Plan B" instantly!

Ron’s gone, but I bet his heirs are happy that he decided to go to an unknown, unpopular, and underdeveloped country, despite what his friends in Houston thought. He diversified into something that others thought crazy, probably suffered some anxiety in the face of his friends’ chatter, but went on with his investment path anyway. He did very well for himself while he was alive, and now for his children and grandchildren.

Ron did his own thinking and charged through the gap. You can too. It’s easy if you follow these 3 simple principles:

- You must observe some long established and empirically proven investment rules about diversification.

- You are required to do your own thinking, even if it means extra effort and slight-to-moderate emotional discomfort.

- You must allow your objectivity and rationality to prevail over fear, or fear will condemn you to a life of mediocrity.

Principle #1: You must follow some rules.

There are established rules for what percentages of your income should be in various asset classes. They vary with age, net worth, goals, and objectives, but they are there and should be followed. Too many people fall prey to greed and ignore the rules when the markets are in full bull mode like they are now. The penalty is severe for most. Diversification is what keeps you out of trouble, but more importantly, it exposes you to the multitude of winners in the various sectors that run counter-cyclical to the NYSE and other traditional markets.

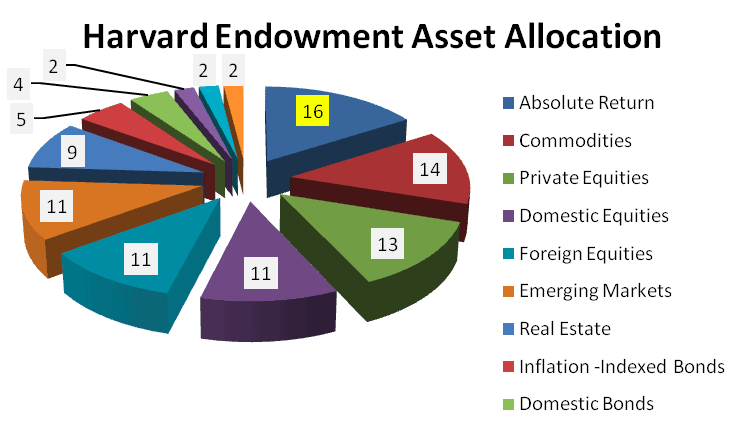

Take a look at the diversification model that a very well know university uses for its $37 billion endowment. It’s chock full of hard asset classes. Look at the Private Equity ownership they include. Look at Absolute Return, Commodities, and Emerging Markets. Look at Real Estate. Harvard alone has over $10 billion in timber assets. Timber, imagine that.

Together, these “alternatives” make up 74% of the endowment. That’s 1% shy of three quarters of their investable assets. When the big money folks think about diversification, they think hard assets and control. Real control and direct ownership, not foreign ETFs and Nestle Stock for international diversification on the NYSE. They want to own physical real estate. They like investments in emerging markets. They see commodity ownership as a hedge to the monetary bubbles and inflation.

The intersection of the three asset classes of Real Estate, Emerging Markets, and Commodities is possible in some cases. If we can find all three in one package, it allows us to gain greater diversification with a single investment, something important when we don’t have $37 billion to invest like Harvard. We need to look for ways to achieve the same goals, but on a smaller budget. When attained, it’s like winning a trifecta.

What’s your investment allocation right now? Think about your portfolio. What do you have invested in these sectors above? Do you have the sector diversification you think you need? Granted, an endowment fund meant to grow money for decades for a school like Harvard is different from an individual’s portfolio…….. Or is it?

If you are 70 years old, you may not feel like you have decades to see a return. If you are living off your investments, this is certainly true. But what if you are in your 40s, 50s, or 60s? Statistically, you have plenty of time to let true diversification and simple compounding return work its powerful magic over time.

For people in their golden years, you may be blessed with more money than you’ll ever need. If so, how are you stewarding these assets for future generations? Are you letting the time factor of that generation’s younger age work for their benefit? Assets that create a long-term legacy return provide a strong multi-decade stability for families far into the uncertain future.

Principle #2: Never let other people do your thinking for you.

“But I would never let other people do my thinking for me.” Really? Let’s see.

Nicaragua.

What’s the first thing that comes to your mind? Is it a positive word association? Be honest, is danger what you thought of when you saw the word Nicaragua? Not really surprising. Most folks do. But unlike “most folks” who won’t continue, you are very likely desire the facts yourself and draw your own conclusions, aren’t you?

If you didn’t think about excellent healthcare, a booming economy, technology companies, call centers, manufacturing, BellSouth, Unilever, Quiznos, TGI Fridays, Payless Shoes, Radio Shack, and a host of other international companies all doing a growing business here, chances are someone else has been doing your thinking for you. Check out a recent article here about the last 10 years of economic growth and stability in Nicaragua. Nicaragua and President Ortega: Ten Years Later.

CNN and the other news organizations love to cover blood, guts, tragedy, and misfortune. Sure, there was a civil war in Nicaragua. 27 YEARS AGO ! The media left before the blood was dry to cover some other tragedy and misery to keep ratings high and advertisers happy. The reason you have lingering negative feelings is that the only real news from Nicaragua in the last 27 years has been largely good news, and when was the last time you read or saw that on TV?

Did you know that Nicaragua has the region’s second highest GDP growth in the last decade? Did you think of a country ranked by the World Bank as “The country that best protects investor rights?” Huh? Did you know Nicaragua is either first or second in safety statistics for Central America year over year for the past decade? Not what we imagine, is it?

And Nicaragua is a growing tourism mecca. This is important to investors because tourists lead the investment community. Tourism growth is up more than 10% per year, every year in the last decade. More visitors means more people seeing the reality for themselves, some of who get the joke and make investments. The perception gap is closing with each and every investment made. And remember, the gap is where the money is, right?

Just know that people are flocking to walk the streets of the 500-year-old city of Granada, where it also attracts large numbers of expats who want to retire to Nicaragua. The surfing in Nicaragua is some of the best surfing in Central America, bringing a flood of tourists and surfers from Southern California, tired of crowded waves and cold water. People young and old zipline through the cloud forests of Nicaragua, soaring over organic coffee plantations with howler monkeys as company. These, and many other great activities, are the reasons more than a million tourists flock to this safe, and yes, business-friendly country every year.

Baby Boomer Surfers Enjoying 80-degree Pacific Waters and Empty Waves at Gran Pacifica

Zip Line Through the Cloud Forest

Oceanside Golf at Gran Pacifica

500-year-old Colonial Granada, Nicaragua

So, who is reporting the 27 years of democracy, the embracing of free market economics, and all the great strides forward socially and economically? Possibly it’s there on page 36 of the major papers, and The Economist will report good news from time to time. Nothing beats boots-on-the-ground and serious investors coming to visit Nicaragua to see with their own eyes, walk with their own feet, think for themselves, and draw their own conclusions.

The real information, the empirical data that will guide an informed investment decision is there. You just have to dig for it. A small investment of time and money to visit Nicaragua might uncover the best long-term investment you’ll make this decade. It’s this “little extra effort” that could pay off with huge dividends in your bank account.

Principle #3: Risk and the perception of risk are two very different things.

“The Gap” is where the greatest profits are. It’s called arbitrage on Wall Street. Seeing the gap, and then having the guts to charge through, is what produces greatness. In sports, it’s what separates the average college running back from the one who makes the pros. In business, the elite see the “gap of information” and that’s where they make their mark. They see the hole and run hard to make it through before it closes. The same is true in the investment world. Only the hole is not a physical one, it’s mental, and when the hole closes, so does the opportunity for big profit.

My wife has several good friends who, upon hearing we were moving to Nicaragua, were outwardly happy for her. But when asked when they were coming to visit, responded, “You’ve got to be kidding. I would never go to Nicaragua.” So, what’s the point? I have two daughters. Those of you with kids know, that as parents, we would give our lives for our kids. There is no way I would put them in danger. The perceived risk was high, the real risk actually much lower than living in most U.S. cities.

The Cobb Girls Enjoying the Surf at Gran Pacifica

INCAE Business School Managua, Nicaragua

INCAE, the Harvard Business School affiliate here in Managua, ranked Nicaragua as the safest country in Central America. And it actually ranked ahead of many cities in the United States. But I understand that fear can be irrational. Statistics and reason don’t make us feel better. That is the nature of fear.

The gap between risk and perceived risk is where the great profits are made. But fear is a powerful de-motivator. Even when the real risk is extremely low, you may find yourself unable to seize an opportunity and charge through the gap. But you can decide to overcome fear. People do it all the time. It’s especially easy when the facts line up to give us confidence in that decision.

When you do what you fear most, you conquer fear. Success is the result.

Diversify

The diversification model of the Harvard Endowment shows the critical importance of sector diversification. You can participate and mirror the strategies too, but it takes some work. It takes digging into the facts for yourself. It requires setting aside preconceived notions and stereotypes pounded into our heads by the likes of Tom Brokaw and the mainstream media. It requires us taking some risk, yes, but measured risk, and some thick skin to deal with the silly nonsense from friends who may let others do their thinking for them. If you are reading this, you are likely in a good spot to keep an open mind and consider alternatives the average investor won’t.

One example of convergence in the three powerful diversification sectors is ownership of a parcel of teak timber in Nicaragua. This is the trifecta of owning Real Estate in an Emerging Market, planted with a highly valuable, internationally demanded Commodity. Please note, for transparency, that I am a part owner in the parent company, Gran Pacifica, who plants, maintains, harvests, and then replants the trees for the next cycle.

The fact that you can own a ½ hectare of baby trees for less than a reasonably equipped Toyota Camry or a Ford F-150 is amazing. Imagine owning a long-term, cash-flow asset, one that appreciates over time and something that helps the environment. Now add that this is an investment that creates a multi-generation legacy for your family, and you’ll see that owning Nicaraguan teak timber could be a pretty sweet opportunity for you.

$30,000 Depreciating Assets: Camry and F-150

Teak Timber – A Legacy Investment for You, the Kids, Grandkids, Great-Grandkids, and Beyond.

I started my first teak plantation 19 years ago with trees pictured above in Panama, to the heckling of some friends and business associates in the small town where I lived then. This timber will be ready for harvest in 7 more years for an exceptional ROI, then replanted for the next harvest for my girls. The land alone, meanwhile, has seen its own 800% increase in value.

“There is no competition once you get outside the masses.

Strive to be outside the competition.”

Gran Pacifica has an ongoing planting schedule annually, whether or not it sells any of the planted parcels to 3rd parties. Our company understands the powerful benefits to our investors when we find ways to combine Emerging Market with Real Estate and a Commodity that has been popular and in demand worldwide for more than 300 years. We will continue to capitalize on this investment internally, because we know the value of being outside the competition. Can you see it too?

To read more about teak timber in Nicaragua, the winning trifecta of asset sector diversification, click here.

Follow the Rules

These three simple rules help me understand why wealthy, sophisticated investors do well over the long term while so many others do not. They live by these principles. They don’t always win, but they greatly improve their odds of doing so.

- Observe long established and empirically proven investment rules about diversification,

- Do your own thinking, even if it means extra effort and slight-to-moderate emotional discomfort, and,

- Allow your objectivity and rationality to prevail over fear, or fear will condemn you to a life of mediocrity.

Following the investment rules is certainly a key to your success. Without rules to establish parameters, you may wander  from fad to fad and fall trap to emotions like greed. Rules keep us focused and in balance. But rules that bind us and limit our ability to see the gap do us no good. Rules that encourage exploration, a commitment to the facts, and give us long-term focus are the ones that the ultra-wealthy employ. We can too.

from fad to fad and fall trap to emotions like greed. Rules keep us focused and in balance. But rules that bind us and limit our ability to see the gap do us no good. Rules that encourage exploration, a commitment to the facts, and give us long-term focus are the ones that the ultra-wealthy employ. We can too.

By doing our own thinking, we are more likely to get in at the ground floor of opportunities. The little extra effort required to do our own thinking pays off handsomely. And finally, reading the gap, knowing that there is a difference between perceived risk and actual risk, allows us to succeed where others fear to tread.

Set some rules. Examine those rules and be sure there’s room to work. Stay disciplined and stick to them. Do your own research, dig a little bit, and see what opportunities are out there – perceived to be “in the fringe.” Finally, make a commitment to yourself that you will do what you fear most and conquer that fear. Do those things and see what a difference it makes in your life.

Michael K. Cobb is the CEO and co-founder of ECI Developments which has properties throughout Latin America. He speaks all over the world on international real estate and is a board member of the National Association of Realtors.

Michael K. Cobb is the CEO and co-founder of ECI Developments which has properties throughout Latin America. He speaks all over the world on international real estate and is a board member of the National Association of Realtors.

Like Our Articles?

Then make sure to check out our Bookstore... we have titles packed full of premium offshore intel. Instant Download - Print off for your private library before the government demands we take these down!