Why I Chose Teak Over Legos

Time Magazine once published an article explaining how Legos have a higher return on investment than stocks, bonds, or gold. Huh? Well, actually, yes in some cases. More on that in a minute.

But maybe a good question to ask is, “Why does an article like that catch my eye?” Sure, having stocks, bonds, rental properties, precious metals, etc., makes a lot of sense. It does for most people. It does for me, too. Up to a point.

Then what? More of the same? More eggs in the same basket? What about sector diversification? What about global diversification? How can I spread out my nest eggs into some new and different baskets? Reading an article like the one in Time gets me thinking about outside-the-box options that might make sense, too.

Mike Cobb and teak investors on his 19-year-old teak plantation.

Mike Cobb and teak investors on his 19-year-old teak plantation.

Let me relate a quick story. 19 years ago, Shepherdstown, WV, was my home and I was a member of the local Rotary Club. Business had me traveling to Panama about once a month, first scouting for land, then interviewing plantation managers, and finally purchasing 100 acres and planting 40,000 baby teak trees on it by later that summer. Some of my colleagues at Rotary thought I was out of my mind.

“You are going to do what?” they exclaimed. “Buy land in Panama? Plant trees and wait 25 years to harvest them? What are you thinking?”

Well, here’s what I was thinking. My research at the Library of Congress (pre-google) showed about a 14% IRR over 25 years if I made an investment into a teak plantation.

A 14% internal Rate of Return? For 25 years? This is a monster ROI. If I could see it, why couldn’t others? Sadly, I have given up on this question. But, when the folks at Rotary would tease me, here’s what I said to them:

A. In 25 years, I’m going to need the money and be really glad I did this.

B. In 25 years, I’m NOT going to need the money and be really glad I did this.

Well, it’s been 19 years, and I’m really glad I did this. I’ll be even happier in 6 more years at harvest when I receive the first harvest proceeds. Then I’ll replant, and the next cycle will be for my girls.

But I’m still planting new baby teak trees. I have trees going in the ground right now. I’ll keep planting new trees every year for the foreseeable future, too. Why not? Money I don’t spend will be left in legacy for my heirs. There’s everything right about that, too.

20 years will come…no matter what. Plant the trees.

20 years will come…no matter what. Plant the trees.

Experience the Insider community that takes your international lifestyle to the next level. Download your FREE guide

"18 Steps to Implementing Your Plan B" instantly!

Low Risk, High ROI

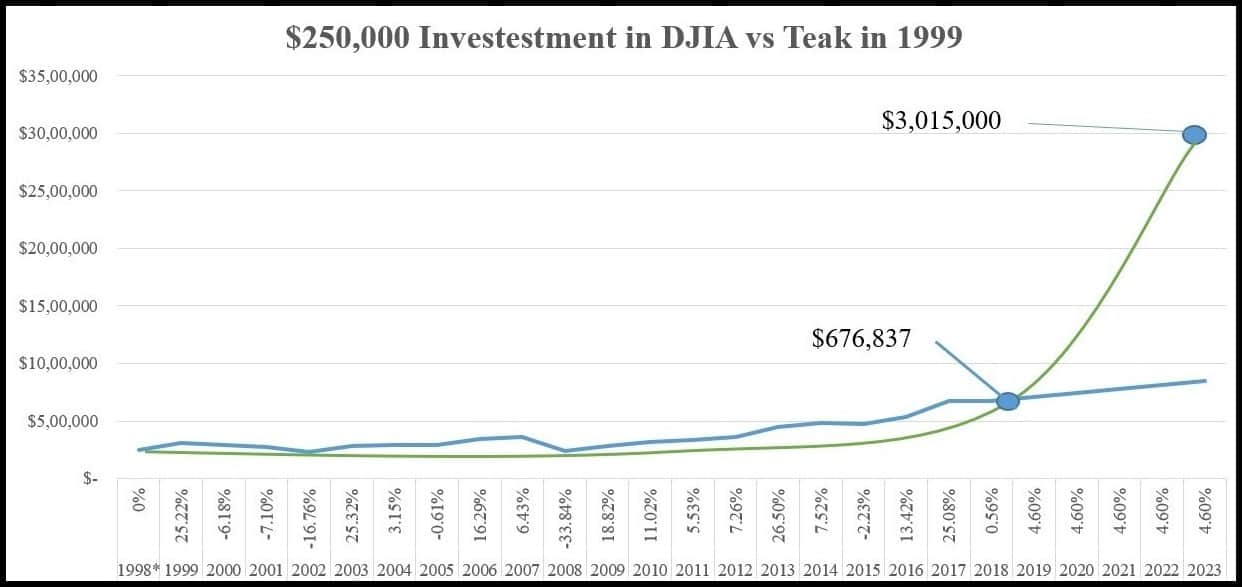

Back to Legos and the article in Time Magazine. Interestingly, some Lego sets have increased in value around 12% annually in the past 15 years. Stock indexes, like the S&P 500, have increased in value only 4.2%, and gold has increased in value only 9.6% annually in that period.

The Time article wasn’t suggesting you race out and buy Lego sets. They note that it would be difficult to invest any significant amount of money in Lego sets, even with such a high ROI. The logistics of purchasing and storing the sets alone would be daunting, not to mention the time that would go into keeping tabs on such a niche market.

But even more important, we have to ask ourselves, “Are Legos a fad?” It’s hard to know, of course. Most folks probably remember the Beanie Baby fad, where some Beanies skyrocketed in value only to fall back to earth as interest waned in a year or two. Staying power in the marketplace is key, too.

Drawbacks to some investments aside, there’s an important lesson in the Time article. Traditional investment avenues, such as stocks, bonds, and gold do not always earn the highest ROI. There are many ways of getting significantly higher returns than you’ll get on stocks if you know where to look.

My research into Plantation Teak provided me with 3 pleasant surprises. I learned that:

- Teak carries with it less risk than investing in traditional markets like stocks.

- Teak offers a better return on investment than average stocks.

- Teak has a 300-year track record of plantation growth, industrial use, and commercial demand.

Less risk, a higher return, and a 300-year track record? How can it be that I was just learning about this then? I wanted to know more.

So, I dug in deeper. Further research showed me that a conservative internal return rate (IRR) for an investment in Teak is 8.07%. This is assuming the price of teak stays consistent throughout the growth cycle. However, if Teak continues to increase at its 100-year historical annual rate of 5.5%, the IRR for an investment in Teak would be 14.01%.

WOW. Where else could I earn a double-digit IRR over this long a period? With the facts lining up nicely, I decided to act. A couple other folks and I decided to share the investment, so we bought the land and planted 100 acres of teak.

Teak’s IRR shows up in the final leg of the race. And, oh boy, does it show up!

Teak’s IRR shows up in the final leg of the race. And, oh boy, does it show up!

And it gets even better. Teak is also an incredibly stable investment. The beauty of investing in teak is that you’re investing in a commodity as opposed to a company. Teak trees are hardy and naturally grow in the tropical climates where they are raised on a plantation. Once the seeds are planted, the trees will grow and grow with very little outside maintenance required.

Even in years of real estate and stock market crashes, your assets continue to climb in value. Literally. Inflation starts increasing? Doesn’t matter to the teak! It continues to grow. International politics causing gas prices to shoot up and then crash? The teak doesn’t care. It continues to grow.

In addition to being insulated against external financial factors, Teak is also largely insulated against external environmental factors. The teak tree truly is a marvel of nature. At the ripe young age of only 3 years, teak trees develop natural resistances to rot, fungus, fire, and termites. The types of calamities that could plague other hardwoods are generally not a concern for teak.

The extremely hard teakwood and high oil content are highly sought after. Its unique qualities have carved out for it an established role in the manufacture of such products as high-end furniture and boat decking. Very expensive furniture. These reasons are why the Brits started farming Teak in the 1600s.

Expensive teak furniture made from scrap teak lumber.

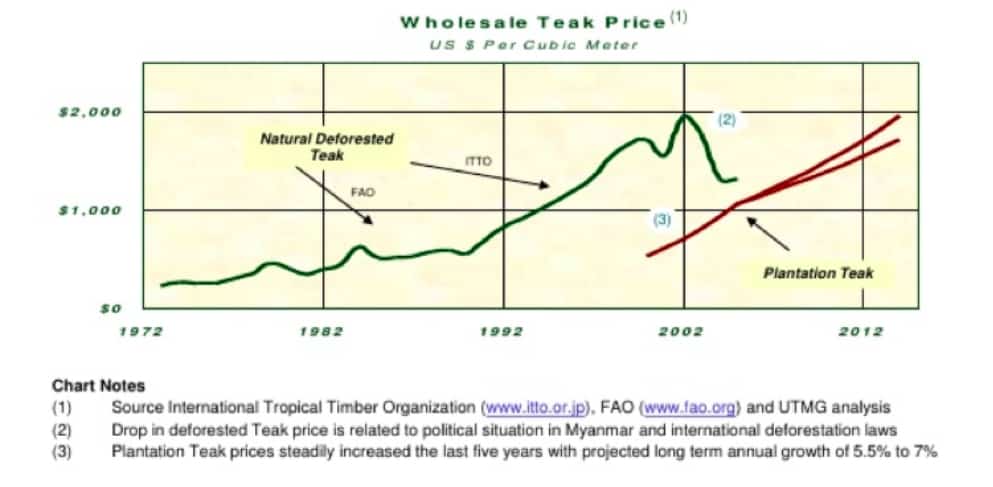

Not only is the teak tree itself incredibly resilient, but it would appear that the market for teak lumber is as well. Teak prices have historically increased at an average rate of 5.5% annually over the last 100 years. Long-term price growth driven by increasing demand.

While we can’t know the future, demand is growing while supply dwindles. Even today, teak trees are being harvested at a rate 8-12 times that of replanting. Besides India, there are only 3 countries in the world where teak grows naturally. All of these countries have enacted laws placing strict quotas or even outright banning on the felling of native teak trees. This has substantially curtailed the global supply of teak, despite the fact that demand for it is rising at an incredible rate.

Plantation teak now more valuable than old-growth teak.

Plantation teak now more valuable than old-growth teak.

Plantation teak looks to fill this void. Its price in the market continues to skyrocket, eclipsing the price of natural teak in the marketplace as of 2008. However, unless thousands of investors plant tens of thousands of hectares of teak, the shortage will intensify. So far, only a small number of investors are seeing this opportunity.

But this is GREAT news for me and other savvy investors who get on board and decide to own teak.

As the scarcity of teak increases, the price only goes up if the laws of supply and demand continue to hold true. Evidence of this is that teak prices have increased by an average of 7% annually during the last decade. Even the 14% IRR going forward may be on the low side.

The other factor at play is the positive impact of the time element. While hard for some people to fathom, the long cycle investment is precisely what appealed to me. The longer growth cycle insulates teak investors like me from the “fast to market” to capitalize on a fad crowd. As the demand for teak lumber continues to exceed the replanting, shortages are likely to appear in the marketplace.

Kenny Rogers and Dolly Parton sing “You Can’t Make Old Friends.” Likewise, you can’t grow 25-year-old teak in a couple years to meet a surge in demand and higher prices. You have to have planned and acted way ahead. Imagine having a multi-year lock on the market when prices of this precious commodity skyrocket?

By the way, investing in teak isn’t a new concept; the ultra-wealthy have been doing it for centuries. There’s a reason that those with money stay wealthy. It’s because they have the foresight and informational resources to seek out the best investment options and pursue them. Teak is one of these options.

A Sound Idea Beyond Dollars and Cents

My continued planting of baby teak trees is, for many reasons, far more than just a low-risk and high-ROI investment. Residency in a foreign country is one of the benefits I can claim if I choose to do so. When you own teak in many countries, you may become eligible for an Investor Residency Visa.

Teak is also an environmentally responsible investment. My teak ownership promotes reforestation, job creation, and sustainability in areas needing employment. In many cases, the environmental repair is critically needed due to decades of slash and burn agricultural practices. I feel great about helping people and the environment while building generational wealth for myself and my family.

I have to thank my parents for helping me become an individual with long-term vision and the ability to think outside the box. I know the incredible benefits of generational wealth stewardship and how building a legacy asset like teak will continue to fund the education of future generations of the Cobb family.

This is my extension of the legacy they built for me. What’s yours? What are you leaving as a legacy for your kids, grandkids, and those beyond?

For more information on Investing in Teak, we have a special Teak webinar for you. I know you’ll really enjoy it!

Michael K. Cobb is the CEO and co-founder of ECI Developments which has properties throughout Latin America. He speaks all over the world on international real estate and is a board member of the National Association of Realtors.

Michael K. Cobb is the CEO and co-founder of ECI Developments which has properties throughout Latin America. He speaks all over the world on international real estate and is a board member of the National Association of Realtors.

Like Our Articles?

Then make sure to check out our Bookstore... we have titles packed full of premium offshore intel. Instant Download - Print off for your private library before the government demands we take these down!