I have a friend who is an investment banker in one of the top-tier asset management firms in London. He says one of the cardinal rules they must live by on the jobs is a simple: Don’t Lose Our Money. The admonition not to lose money is important for investment bankers who are trusted with making decisions that could affect the financial security of individuals, family, and even companies. The simple rule of “Don’t lose your money” is also important to us even though we are not professional investment bankers.

This piece seeks to explore how investors are starting to embrace the security provided by gold investments.

If you are reading this, it is safe to assume that you are not living from hand to mouth and that you have a little extra that you can put away for safekeeping or for the multiplier effect from investing. Many people invest in real estate, equities appeals to others, some love the thrills and excitement of futures, commodities, forex, and many others are in love with precious metals.

Whatever, your preferred investing method, the underlying goals of the average investors is firstly, asset preservation (not losing your money) and secondly, asset multiplication (making gains on your investment).

Gold is making a comeback

Empires rise and fall, people live and die, technologies thrive and become obsolete, but two asset classes have survived through the ages to maintain their investment allure. Gold and real estate are two asset classes that have survived through hundreds of years to remain relevant in current times despite the fact that the 21st century economic landscape is different from the economic landscape of the Middle Ages.

Some hundreds of years ago, he who owns the lands owns the economy and though we no longer live in an age of serfs and barons, real estate is still considered the only “REAL” asset class in existence today. Real estate might no longer be as hot as it was in some markets but banks are still making a lot of money on mortgages.

Gold also holds an important position as a source of economic power and countless wars have been waged (justly and unjustly) in a bid to take over real and imagined gold treasuries. Gold maintained a strong economic appeal over the last couple of centuries when it kept faith in fiat currencies. However, the influence of the yellow metal started to wane in the last couple of decades when the U.S. got off the gold standard and gold bears became more vocal.

However, gold is starting to make a comeback as the global economic landscape starts facing new bouts of uncertainties. The current geopolitical landscape is casting dark shadows on the global economic outlook.

To start with, crude oil prices are depressed due to a supply glut, inability of oil producers to agree on supply, cuts and geopolitical tensions in the Middle East. Equity markets are depressed because of weakness in China, Britain in threatening to leave the EU, it is an election year in the U.S. and economic policy is not concrete. All the aforementioned factors have made investors to rethink their risk exposures and now, more and more people turn to g old for investments.

Investors are seeking refuge in gold

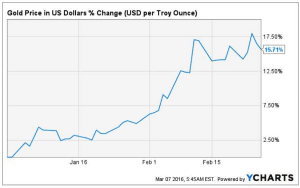

Gold is on the rise because investors are starting to seek refuge in the safe-haven status of gold. Gold started 2016 on an impressive note and the investors in the yellow metal are finding reasons to smile to the banks. The uptrend in gold this year contrast sharply with the more than 10% losses that the bullion recorded in 2015. The chart below shows how gold has fared in the year-to-date period. Gold has gained 15.71% in the year-to-date period.

Last Friday, gold prices surged to a 13-month high of $1,279.60, to mark the highest trading price since February 3, 2015. The yellow metal later dropped some of those gains after U.S. nonfarm payroll data showed better-than-expected 242,000 jobs created. However, the yellow metal still held on to much of the gains to settle with 0.2% gains at $1,262.05 an ounce.

Last Friday, gold prices surged to a 13-month high of $1,279.60, to mark the highest trading price since February 3, 2015. The yellow metal later dropped some of those gains after U.S. nonfarm payroll data showed better-than-expected 242,000 jobs created. However, the yellow metal still held on to much of the gains to settle with 0.2% gains at $1,262.05 an ounce.

The gains being recorded in the price of spot gold shows that the demand for physical gold is rising as investors seek refuge in the safety provided by gold. The rally in gold has a ripple effect pulsing through the stocks of miners and gold ETFs. For instance, inflows into gold ETFs has increased by more than 8% in the year-to-date period. Last Friday, holdings in eight major gold ETFs increased to 43.3 million ounce to mark the highest holding since July 2015.

Experience the Insider community that takes your international lifestyle to the next level. Download your FREE guide

"18 Steps to Implementing Your Plan B" instantly!

Bill O’Neill, co-founder of commodities investment firm Logic Advisors in New Jersey confirms the fear-driven rally in gold to Reuters. In his words, “we’re in a global fear mentality right now and it’s at a level now that is attracting interest in gold as an alternative asset.”

Another analyst notes that “Equally important is that gold has been able, finally, to sustain a rally.” George Gero, precious metals strategist for RBC Capital Markets in New York notes that “there are enough compelling reasons for haven seekers to return to gold, especially in view of gold being liquid, portable, convertible to any currency and without political allegiance.”

If you would like more information, please Contact Us with any questions you may have!

~ Luis Aureliano

Like Our Articles?

Then make sure to check out our Bookstore... we have titles packed full of premium offshore intel. Instant Download - Print off for your private library before the government demands we take these down!