International Banking and Financial Entity Risk Assessment

Risk assessment for international banks and financial entities is the analysis of both internal and external forces. Internal lending and transaction procedures are weighted against capital ratios and lending risks. External forces are the transactions going through your bank and the KYC, AML and BSA risks they pose to you and your correspondent partners.

The concept of risk assessment is being extended to define the set of activities aimed at ensuring the liquidity of financial institutions and ensuring the legitimacy and legality of transactions being processed through those banks. The analysis of default risk is being combined with risk analysis to include know your customer, know your customer’s customer, source of funds, and anti-money laundering.

Solid risk assessment for international banks protects the business on two fronts: 1) ensures the compliant and risk averse operation of the bank, and 2) keeps your correspondent banks happy.

There are three things that keep an international banker up at night. They are correspondent bank, correspondent banking, and correspondent banking. Anyone operating an international bank knows how hard it is to setup and maintain these relationships.

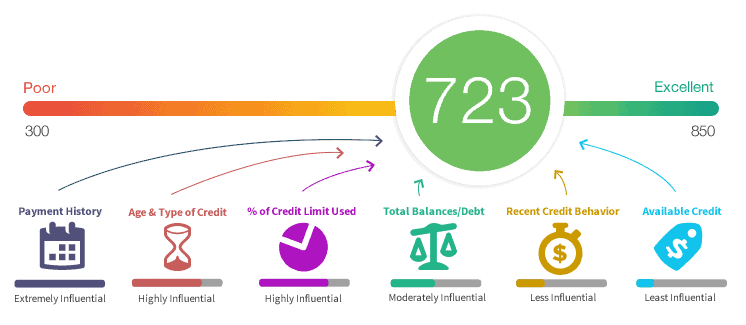

Analysis of credit risks in financial institutions.

The assurance for the “quality” of the risk is one of the most important missions in financial institutions, having proper credit risk for example is one of the many challenges financial entities face.

The process of managing risk assessments would cover the following phases:

- Defining the approach / objectives pursued

- Identification of critical risks

- Measure and estimation of amounts, frequency, etc.

- Proper analysis of the risks

- Implementation of risk management actions

- Monitoring, control, report generation and preventive response measures

The risk of the financial entities must be planned in accordance with the means and information available, managed and controlled. For risk analysis, financial entities work with different models:

The Credit Scoring or Automated Valuation Model. This statistical model, usually applies to small risks, which uses the statistical techniques of discriminant analysis and multiple regression based on data such as; age, marital status and time spent in the same area, number of children, type of employment and seniority, position, company, amount of the requested loan, destination of the same, etc.

This information is inputted in a form and each one is assigned a valuation according to the criteria of each entity, with a final result that automatically determines the origin of the requested risk concession.

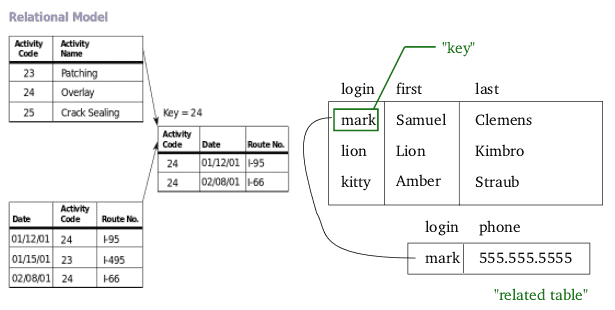

Relational Model.

Based on the exhaustive analysis of the information held by the entity, derived from the previous relationships with the client, positively weighing the good trajectory of the client with the entity.

Experience the Insider community that takes your international lifestyle to the next level. Download your FREE guide

"18 Steps to Implementing Your Plan B" instantly!

Economic-Financial Model.

It is the most complete and admits variants of great complexity, based on the projection of the economic results and the cash flow expected for the risk applicant. It is the model that offers the most reliability to analyze important amounts and complex risks, usually derived from corporate clients. It is usually accompanied by the Relational Model.

For the application of any of the above models, financial institutions rely on:

Information.

That can be obtained directly, such as the documentation provided by the applicant and the visit of the analysts to the company and its facilities; as indirectly through different associations, registries or entities such as: Experian Bureau of Credit (Badexcug), OFAC, Official Registers, (Mercantile, Property, etc.), commercial information agencies, customers, suppliers, competition, or any other that we may find interesting and reliable.

The Risk Analysis departments that issue the risk reports or proposals, where the results of the analyzes made by the team of professionals that can collect data related to: the moral solvency of the applicant (Character), its capacity to generate funds are collected (Capacity), the available own resources (Capital), the collaterals provided (collateral) and exogenous factors (Conditions) such as the situation of the economy, the sector of activity, perspectives, etc.

The management of commercial risk in companies: Credit Management

The granting of commercial credit is always a battle between the sales and risk assessment departments, since it is usually the latter that makes or requests the information to verify the solvency of the client. The person in charge of credit analysis analyzes new clients, monitors existing ones, requests financial information from clients, collects information on risks from commercial information agencies, manages and requests sureties and guarantees, denies or limits sales with deferred payment and blocks or releases orders according to the risk limits assigned to customers.

The person responsible for risk analysis participates, or should do so, in the definition of the company’s risk strategy as well as the credit and collection policies. It also grants the credit lines and marks the risk limits for each client, tracking the outstanding risk and determining the payment conditions.

It should also be responsible for the control and management of customer balances, monitoring overdue balances and making arrangements so that the collections are materialized in time and form, both those due from which the payment has not been received and those that have been unpaid. after being sent to the bank to manage their collection, taking charge of the opening and preparation of the dossier with the documentation regarding the non-payment, to use it as appropriate to procure the recovery of the credit.

Conclusion

Procedures for risk assessments are tedious and managing the data is a risk in itself. Financial institutions need to provide an inordinate amount of information to the US government and the local government. For more information on setting up an International Financial Entity, or with correspondent banking and risk assessment, please contact us HERE.

I hope you enjoyed reading: International Banking and Financial Entity Risk Assessment. Here are a few additional articles I know you’ll love!

Want to Buy Property with Your IRA Loan But Short of Funds? Have Your IRA Get a Loan!

Diversifying Your Assets With Land Banking

Characteristics and Legal Status of Offshore Incorporated Companies

How North Americans Can Grow Their Wealth

Like Our Articles?

Then make sure to check out our Bookstore... we have titles packed full of premium offshore intel. Instant Download - Print off for your private library before the government demands we take these down!