The Ultimate Guide To Going Offshore

Everything You Ever Wanted To Know About Eliminating Your Taxes, Protecting Your Assets And Regaining Privacy Over Your Life and Investments.

The Ultimate Guide to Going Offshore will give you an excellent understanding of Offshore Banking, Offshore Incorporation, Offshore Asset Protection & Trusts, Offshore Tax Strategies, Offshore Self Directed IRA and Second Residency & Second Passports. However, this guide does not replace individual tax or legal advice from a licensed professional and should not be construed as such; we suggest speaking with a top-quality CPA who understands these types of strategies thoroughly before taking any action.

For further information, check out this podcast from The Expat Money Show with Mikkel Thorup – 057: Jeff Berwick – Founder Of The Dollar Vigilante Discusses Libertarianism and Anarchy For Expats

How This Guide Works

For those of you who don’t know us here at Escape Artist, we are one of the world’s largest and oldest expat resources in the offshore market. For over 22 years we have helped and guided businesses and individuals and have a history of earned trust by providing our clients with the most comprehensive source for information, resources, analysis, and insights for the internationally-minded. We have offices in the United States, Belize, Panama, and Portugal. Escape Artist was established with a mission to inspire and engage consumers with credible news and unique content while building an international expat community.

Whether you are a seasoned entrepreneur ready to structure your business and finances internationally today, OR you are at the beginning stage of learning and understanding so that you can implement these strategies in the future, Escape Artist is here to help you. You can go directly to your area of interest via the Table of Contents.

Or you can read the entire guide cover to cover starting with:

Part 1 and follow the sequential order of this Guide starting with Offshore Banking. Once you are ready to open an offshore bank account, you can contact us HERE

Part 2 is setting up an offshore company. If you have any questions regarding any of the topics covered in this section, like how to incorporate overseas or the best locations to set up your company, you can contact us HERE

Part 3 is Asset Protection. We have partnered with a law firm with arguably one of the best asset protection lawyers in the USA. Why would you want to go anywhere else? Contact us HERE when you’re ready to protect your assets and wealth by going offshore.

Part 4 is about understanding Tax Strategies while going offshore. This will help reduce your tax burden substantially. To talk with the Accountants we trust, go HERE. And finally,

Part 5 where we bring it all together with helping you create an effective Self Directed IRA so when you retire you have more of your hard-earned money. To talk with our SDIRA specialist, contact us HERE

Part 6 is a short bonus section where we share with you the best articles on second residency and second passports from our several thousand content pieces on this subject. If you are looking to purchase a residence or citizenship by investment then reach out to us HERE and we will do our best to assist you.

Why Should You Read This Guide?

All of us are looking for ways to protect and grow our wealth but there are plenty of agencies and individuals out there that are aching to take a big bite out of your apple. Whether it’s your ex-spouse, a disgruntled employee, a slacker sibling an ambulance-chasing lawyer or good old Uncle Sam trying to stick his hands in your back pocket, there are a lot of people who’ve got eyes on your assets!

So what is the best way to protect and expand your wealth?

In this Ultimate Guide, we are going to break down everything you need to know about going offshore as well as give you all the resources and access to the professionals to help you move offshore in the safest and easiest way possible.

One last thing before we get into the meat of this guide; this may be the most comprehensive guides on how to internationalize your life by going offshore on the internet today. To download a copy for your personal library, all you need to do is Click Here and I will send it to you by email.

TABLE OF CONTENTS

Offshore Banking – The Ultimate Guide To Going Offshore

- The Safer Alternative

- The Legality Of Offshore Banking

- Why Should I Get An Offshore Bank Account?

- What Do I Need To Open An Offshore Bank Account?

Offshore Incorporation – The Ultimate Guide To Going Offshore

- What Are Corporations

- What Is Offshore Incorporation?

- The Advantages Of Offshore Incorporation

- Access To Specialist Financial Services

- Anonymity Guaranteed Offshore

- Greater Profits For Reinvestment Or Returns

- Low Costs Of Operation And Access To Specialist Skills

- How Do You Incorporate Offshore?

- What Documents Do I Need To Provide To Open An Offshore Company

- Best Countries To Start An Offshore Company In

- Virtual Office Or A Physical Office Offshore

Asset Protection – An Offshore Trust – The Ultimate Guide To Going Offshore

- Why Do You Need An Offshore Trust?

- Is Tax Avoidance Through Trusts, Legal?

- Planning Out Your Tax Strategies Through Trusts

- What Is A Trust And How Does it Protect You?

- The Types And Advantages Of Trusts

- Why Use An Offshore Trust?

- Setting Up An Offshore Trust Or A Trust Fund

Understanding Tax Strategies While Offshore – The Ultimate Guide To Going Offshore

Foreign Earned Income Exclusion (FEIE)

- Foreign Earned Income Exclusion (FEIE)

- FEIE Requirements

- Bona Fide Residence Test

- The Physical Presence Test

- How Long Can You Travel In The USA With The FEIE

Foreign Bank Account Report (FBAR)

- Foreign Bank Account Report (FBAR)

- FBAR Filing Requirements

- Who Can File FBAR?

- What Should be Filed For FBAR?

- Filing Exceptions

- Filing Process

- FBAR Deadline

- Penalties For Non-Compliance FBAR

- FBAR Compliance Policy

Offshore Self Directed IRA – The Ultimate Guide To Going Offshore

- What Is An IRA?

- How Is An SDIRA Different From Traditional IRAs?

- Where Does Offshoring Come Into This?

- How Do I Take My Self Directed IRA Offshore?

- SDIRAs In The Context Of Financial Libertarianism

- How Does An Offshore SDIRAs Fit Into Flag Theory?

- Looking For The Right Custodian

085: Warren Black – International Tax Expert Champions For Sovereignty

Second Residency and Second Passport – The Ultimate Guide To Going Offshore

Offshore Banking – The Ultimate Guide To Going Offshore

Studies have found that many American banks fail to offer customers safe and affordable banking solutions. In some parts of Europe, the situation is even worse as insolvent banks continue to put their customers’ wealth at risk.

Here’s what you need to ask yourself:

What happens if my local bank goes under? What happens to my money?

Will the insurance company bail me out? Will the government step in?

Although it would be nice to have the assurance that your money isn’t going to disappear one day, it isn’t how things work. Insurance companies and the government won’t step in to cushion the blow either.

So, is there another option that provides excellent interest rates, diversification as well as the assurance that your wealth is safe?

The Safer Alternative

Offshore banks are a much better alternative to local banks. They can give you the peace of mind that your money is safe and no one can touch it.

For people with large amounts of wealth sitting in the bank, having an offshore bank account is a must. Unfortunately, opening a bank account isn’t as simple as at it once was; however, the trouble it takes to open an offshore account is worth the effort.

The thing is though that there are plenty of options to pick from and lots of rules and regulations to think about before you decide which country you’ve chosen to open an account in.

Before we delve into how you can benefit from offshore banking, let’s get some of the misconceptions out of the way:

The Legality Of Offshore Banking

There’s no need to start thinking of yourself as a devious villain who’s breaking the rules for your own gain because offshore banking is completely legal—it’s just having trouble shaking off the bad rep it developed over the years.

What’s important is that you know that you do have the right to open an offshore account if you want to, but you aren’t allowed to keep it a secret.

Offshore bank accounts have been constantly linked to large scale corruption cases, but you’re perfectly within your right to take advantage of offshore banking.

Tax evasion is a whole other scenario. Whether you’re evading taxes in the US or abroad, it’s always illegal.

As an American, as long as you’re complying with the laws of the US, you can open an offshore account without any hesitancy. You should take the time to learn the law and to make sure you’re abiding by it.

Once you understand the laws and how they work, you’ll begin to realize the abundance of options you have and how they can benefit you.

Why Should I Get An Offshore Bank Account?

Unstable banking in the US may be the primary reason people look to offshore banks, but there’s also another reason—diversification.

Seasoned financial advisors will always tell their clients to not put their eggs in one basket. Meaning, they shouldn’t put all their money in one place.

The idea of putting your cash into an offshore account is similar to diversifying your portfolio across various asset classes such as blue-chip stocks, gold, real estate, bonds, hardwood plantations, etc.

People are well aware of the benefits of asset diversification but few think about transferring their assets into different geographic locations.

Offshore banking reduces your risk and increases your benefits.

Opening up an offshore bank account protects your wealth and gives you more flexibility.

Here are the benefits of diversifying your portfolio:

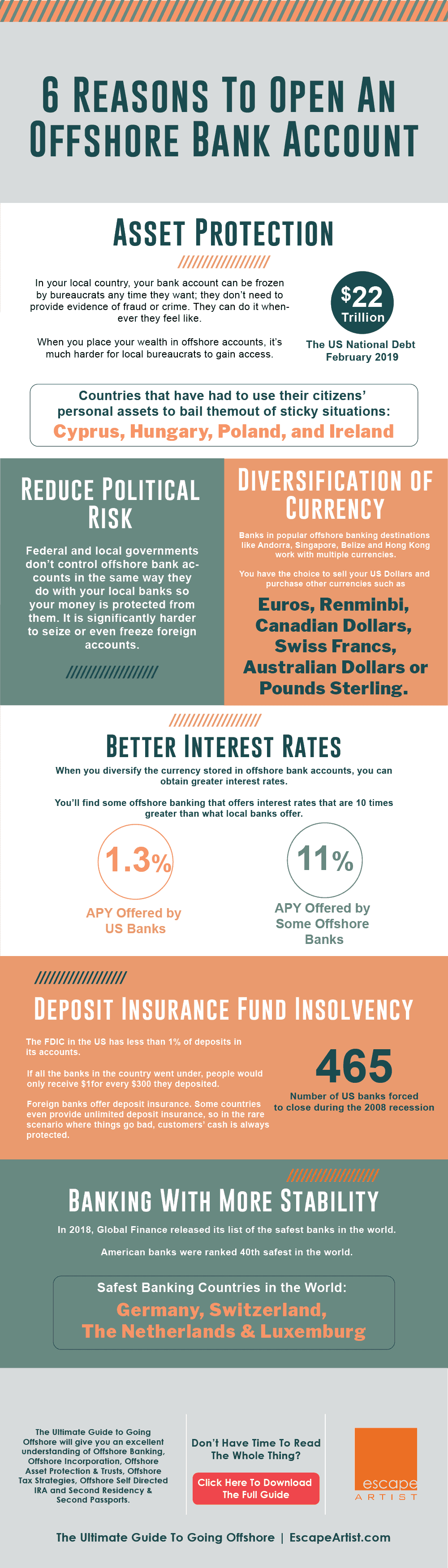

1. Reduce Political Risks

Politics has never been stable but these days it’s worse than it ever was in the past. As someone with assets in the bank, it’s natural to feel a little anxious about what can happen to your wealth with the war on the rich.

Federal and local governments don’t control offshore bank accounts in the same way they do with your local banks so your money is protected from them. It is significantly harder to seize or even freeze foreign accounts.

Choosing to keep your money in offshore accounts gives you the option of picking a bank in a politically stable country. Offshore banking also gives you more privacy than you would have in a local account.

2. Asset Protection

When it comes to debt, there are few nations that can rival the US. In February this year, the US national debt reached $22 trillion!

This isn’t a statistic you can ignore.

Governments need for funds often exceed what they gain from bills and tax collections. When push comes to shove, they don’t hesitate to look into people’s personal assets. Countries like Cyprus, Hungary, Poland, and Ireland have all had to use their citizens’ personal assets to bail them out of sticky situations.

In 2011, the citizens of Hungary were forced to leave their private pension plans and enroll in state-run pension plans in order to keep receiving pension payouts.

Two years later, the government of Poland took away the private retirement funds of half its people.

In your local country, your bank account can be frozen by bureaucrats any time they want; they don’t need to provide evidence of fraud or crime. They can do it whenever they feel like.

When you place your wealth in offshore accounts, it’s much harder for local bureaucrats to gain access.

Think about what it would mean if your assets were frozen and you didn’t have access to your wealth for a few weeks, months or even years in some cases.

The idea of having your hard-earned money taken away from you is nerve-wracking for anyone but it’s that much more frustrating for business owners who rely on bank accounts for their operations.

Offshore accounts protect your assets from the government. You don’t need to worry about the government snooping around in your bank accounts if they are opened elsewhere.

It’s not only the government that you have to watch out for. From creditors to an ex-spouse, there are plenty of people who’ve got their eyes on your cash. By placing your money in offshore accounts, you can rest assured that other parties don’t gain access to your wealth.

3. Banking With More Stability

In 2018, Global Finance released its list of the safest banks in the world. American banks were ranked 40th safest in the world. That’s right, we may think of ourselves as the leader of the Free World but when it comes to banking, we’re way behind.

Countries like Germany, Switzerland, The Netherlands, and Luxemburg, take the top slots on the list.

If you had the option of placing your cash into the safest banks of the world, why won’t you do it?

There are many banks in the country that will claim to be safe options but there’s a lot more that goes into keeping your assets safe than a few passwords and secret questions. You need to think about how to best protect your wealth from coked-up Wall Street traders and investment bankers who can put the entire system into jeopardy.

Another thing you need to keep in mind is that wealthy countries don’t equate to safe banking options.

It wasn’t too long ago when European countries restricted people from accessing their own bank accounts. Banks were going under left, right and center and deposit insurance wasn’t much help.

My guess is you haven’t considered offshore banking so far because of two main reasons; it’s not convenient to set up and secondly, you didn’t know how to reap the benefits of offshore banking.

Now take a moment to think of the future. How can you make sure that no one sticks their hands into your pocket and grabs your hard-earned money?

The first step to going offshore is setting up an offshore bank account – our recommendation is opening an account in Belize.

4. Deposit Insurance Fund Insolvency

Here’s a disturbing fact. The FDIC in American has fewer than less than 1% of deposits in its accounts.

In laymen terms, if all the banks in the country went under, people would only receive $1for every $300 they deposited.

Scary right?

Luckily, you don’t need to seek out the leading offshore banks to maximize returns on your savings.

For more than a decade now, the government has said that the FDIC is bankrupt which is why 465 banks in the country were forced to close during the 2008 recession.

Compare this instability to the banking environment of countries like Singapore who have never experienced failures of banks!

Foreign banks offer deposit insurance. Some countries even provide unlimited deposit insurance, so in the rare scenario where things go bad, customers’ cash is always protected.

Before deciding where to go to open a bank account, you need to look at the stability of the country as well as the stability of the bank you’re considering. In fact, the stability of the bank is a more important factor.

5. Diversification of Currency

The Western world is in a “currency war” right now, which destroys the wealth held by ordinary people every day, see James Rickards book Currency War: The Making Of The Next Global Crisis – for an in-depth explanation of what governments around the world are doing.

You have the option of diversifying your currency by purchasing gold and silver bars/coins and prevent intrusion from central bankers. Other than hard assets, you can also purchase other currency that local entities wouldn’t be interested in taking.

Banks in popular offshore banking destinations like Andorra, Singapore, Belize and Hong Kong work with multiple currencies. You have the choice to sell your US Dollars and purchase other currencies such as Euros, Renminbi, Canadian Dollars, Swiss Francs, Australian Dollars or Pounds Sterling. Through offshore banking, you have access to currencies that are gaining strength or dump others that are losing value.

This also gives you the option when travelling internationally to skip the currency exchange and pay in a local currency, for example when I go to China every year I am not paying in USD, I pay in RMB.

6. Better Interest Rates

When you diversify the currency stored in offshore bank accounts, you can obtain greater interest rates.

You’ll find some offshore banking that offers interest rates that are 10 times greater than what local banks offer.

There are banks that offer 11% annual percentage yield (APY) provided that you don’t withdraw any cash from the account for a specified duration of time. If you consider the fact that savings accounts in the US that offer an APY of 1.3% are thought of as “high yield”. An APY of 11% can make you lots of money—around 10 times higher than what you would have made from a US bank account.

What will that sort of hike in interest mean to you? Would you be able to use that extra wealth to expand your business? Buy a house? Travel the world?

Those that have a better understanding of financial markets can purchase currencies that are on the rise and take advantage of soaring interest rates that can go up to 18% or more.

There are offshore banks that provide 5-6% of APY on American dollar accounts. If you’re not ready to try your hand at making money from purchasing foreign currencies you’ll still be able to generate extra profit just by putting your money into foreign bank accounts.

Think about your financial goals and how much profit you would like to make from your offshore bank accounts. Gather as much information as you can about offshore accounts and weigh the pros and cons of opening bank accounts in different countries.

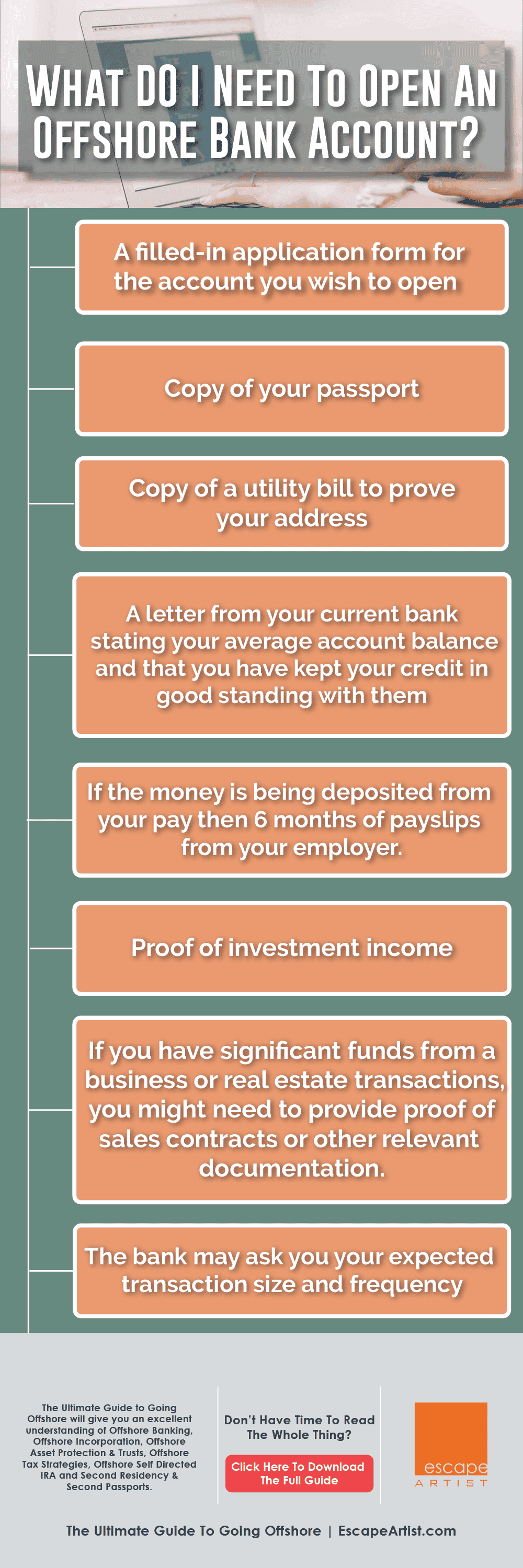

What Do I Need To Open An Offshore Bank Account?

All banks are different and have their own regulations, but you can expect similar procedures to your local domestic bank back home plus a couple of other documents to satisfy their needs. Some of the documents that may be are necessary:

- A filled-in application form for the account you wish to open

- Copy of your passport

- Copy of a utility bill to prove your address

- A letter from your current bank stating your average account balance and that you have kept your credit in good standing with them

- If the money is being deposited from your pay then 6 months of payslips from your employer

- Proof of investment income

- If you have significant funds from a business or real estate transactions, you might need to provide proof of sales contracts or other relevant documentation

- The bank may ask you your expected transaction size and frequency

As I said, every bank will have their own requirements, but you can expect some or all of these documents before they will consider letting you open an offshore account with them. They might also need to have these documents notarized or apostilled before your application.

These document requirements might seem a little obtrusive when opening an offshore bank account but you should understand that governments around the world have been putting a lot of pressure on offshore jurisdictions to stop their clients who fund terrorism, evade taxes or launder money.

But if you are a legitimate business or individual you should have no trouble opening an offshore bank account in a relatively short amount of time.

Conclusion: Offshore Bank Account

If you are searching for a way to legally protect your assets and your wealth from unscrupulous governments and banking systems that are fundamentally unsound, ensure that you do at least a portion of your banking offshore. How about your personal freedom? Kind of important to you? With an offshore bank account, you will add the first layer of protection to your assets.

To set up your new offshore bank account or to get an up to date list of all requirements and see if you qualify to bank with one of the safest banks in the Caribbean, please contact us here.

Handpicked Related Content: 9 Reasons You Need An Offshore Bank Account

Offshore Incorporation – The Ultimate Guide To Going Offshore

Offshore incorporation is one of the best ways for someone to protect their financial assets. The idea that you could transfer your legal and financial liability into a legal entity separate from you, yet still enjoy profits and the benefits from, is one that takes a while to get your head around, but I strongly endorse it. Incorporating into a company has myriad benefits that I think everyone looking to preserve their financial well being should consider because it sets the grounds for long term financial benefits. Offshore corporations get you access to new business opportunities, better tax protection, and unparalleled financial privacy.

Offshore incorporating is a major hassle from a legal perspective. Hence the reason why a lot of people shy away from it, especially if you try to do it on your own without a registered agent. There are also a lot of myths associated with the legality of offshore incorporating that need to be addressed. These are reasons I decided that this guide needed to be written, people should know what they’re missing out on, not to mention how easy the process is if they would just accept a helping hand and be willing to pay for a little bit of assistance.

What Are Corporations

Corporations are recognized as a legal entity that is under the legal system of the country they are incorporated in. As an example, if you incorporate a company in Belize, the company must follow the corporate laws that Belize puts forth. Corporation tax rates and personal income tax rates are two separate financial injunctions imposed by the state. If you own a company, the assets, liabilities, and finances are separate from yours. In the case that some legal action or financial penalties are imposed on the company, they will have no implications on your personal finance; rather, these will be applied to the company, its assets, and activities.

So for all intents and purposes, a corporation is a citizen in its own right with its own legal and financial obligations separate from those of the owners or the investors. A board of directors is responsible for making sure that the company functions properly, fulfills its obligations to the state, its employees and its shareholders. Failure to do so will make it liable for legal prosecution, none of which will be directed at the owners of the company.

A similar pattern is followed by the company’s financial obligations. The owners aren’t personally responsible for the company’s debts, tax obligations or those to their shareholders. Any action pursued in response to any financial-legal terms can’t and won’t be directed at the people who own the company.

Having understood what a corporation is, we can now define what incorporating means. Incorporating is to establish your business as a separate legal identity, in compliance with state laws, whereby you can effectively separate your legal and financial liabilities from those of the company. The ownership can be shared between multiple individuals or be held by just one; anyone involved won’t be held personally responsible for the company’s financial/legal status.

With these things in mind, the advantages of such a setting can become immediately clear. There are ways to save your personal income, move around assets to save up more money and use the company as a shield for your financial decisions. These advantages become even more apparent when you look at offshore incorporating.

What Is Offshore Incorporation?

Imagine that a person was born in the Cayman Islands. As a citizen of the country, they would only be obligated to pay taxes as required by the laws of the Cayman Islands (interestingly enough the personal income tax rate there is 0%). Compared to someone in the United States who might have to pay up to 37% in personal income tax, the citizen of the Cayman Islands has a lot more disposable income. In addition to this, this person doesn’t have to comply with the tax laws in the United States because they have no legal obligations to the country.

Let’s take this analogy a bit further and think about it in terms of corporations and their legal status. As a legal entity recognized by a state, the corporation is treated much in the same way as any other citizen is. It’s expected to comply with all the financial legislation in the country that recognizes its legal status. At the moment, corporate tax in the United States stands at 21%, while in Ireland it is set at 12.5%.

A company making $1,000,000 in the U.S. will have to pay $210,000 in taxes, while the one in Ireland making the same amount of money will have to pay $125,000. As such, the company in Ireland has more disposable income after tax to spend than the one in the United States. This means greater profits for company executives and greater returns for owners of the company.

Offshore incorporating is the exercise of setting up a legal company on foreign lands for greater corporate benefits, which need not be restricted to just the tax advantages. In many cases, you might not even need to be a citizen of that state to set up a company; only the corporation will be liable to the laws and regulations of the offshore location.

The Advantages Of Offshore Incorporation

I’ve already discussed what the potential tax advantages of working with offshore companies are, but there are plenty more where that came from. Although the primary benefits are those of taxes, you can also expect the following advantages by working in offshore locations, based on where you’re set up.

Access To Specialist Financial Services

Across the world, you will find hubs of specialist financial services, like investment expertise or greater financial privacy. Singapore, for example, is well known across the world for being the center of unmatched financial expertise which can help create immensely lucrative financial portfolios. Similarly, the Swiss financial system prioritizes financial privacy as a unique selling point.

Working in strategic spots like Dubai or Hong Kong will give you access to some of the most vibrant business communities which allow you to expand your business potential even further. The sky is the limit; choose whichever location you think minimizes your losses and maximizes your profitability. There are plenty of locations around the world, each of which offers a unique set of advantages.

Anonymity Guaranteed Offshore

A lot of offshore locations refuse to disclose the ownership information of company owners and therefore, help you avoid undue scrutiny on part of any investigative authorities. They will allow a look into the company’s financial records, but even that is iffy. For as long as no criminal activity is being investigated, your assets will be kept completely confidential and your identity will remain hidden which goes a long way to avoid any personal financial or legal inconvenience.

Greater Profits For Reinvestment Or Returns

The tax advantages of offshore corporations allow you to enjoy a larger degree of profitability that you can reinvest or just live off of. Siphoning these funds into other locations where you won’t have to pay very high personal income taxes will allow you to build a strong financial base that you can enjoy.

In addition to this, these greater funds may allow you to look at alternative investment opportunities that could supplement your corporations or into research and development. Working offshore can go a long way in enhancing you and/or your company’s financial well-being.

Low Costs Of Operation And Access To Specialist Skills

Nearshore programming has developed into a huge market during the past few years. Latin America is slowly developing into a tech hub which is now challenging local American markets in terms of cost efficiency and availability of labour. The low labour cost of working in these countries gives a cost-effective edge to all companies, which helps them enhance their profitability even further.

Of course, these advantages are not just restricted to the tech market; there are all sorts of cost advantages that you can dig up across the world to improve your overall profitability.

How Do You Incorporate Offshore?

There is no uniform procedure that is followed across the board for all countries. Each location will have a different set of regulations that you’ll need to follow if you want to set up a company there. You don’t need to worry though, there are companies out there that will help you set up a company in offshore locations – click here to see the company I work directly with.

These service providers work with legal and financial experts who can guide you through the process of setting up a company across borders. Lately, there has been a lot of buzz about setting up companies in Hong Kong, Singapore, Belize and other similar tax havens that allow for huge tax cuts. The service providers I’m speaking of will know which locations fit your exact requirements and will know of all the paperwork required to set up these companies.

The process is fairly simple, your agents from the service provider will manage all of the paperwork and you will just have to handle the fees and gather the documents they request. They will advise you on the best corporation structures you want to follow and will require the following information before they begin:

- What type of company you wish to start out with; IBCs, LLCs, Ltd, etc.

- Who the owners or the members of the company are and their personal information.

- The corporate structure of the offshore company.

- Possible names for the offshore company

This isn’t an exhaustive list of information that you will need to provide, you could speak with me directly or consult with an offshore incorporation services provider to help you.

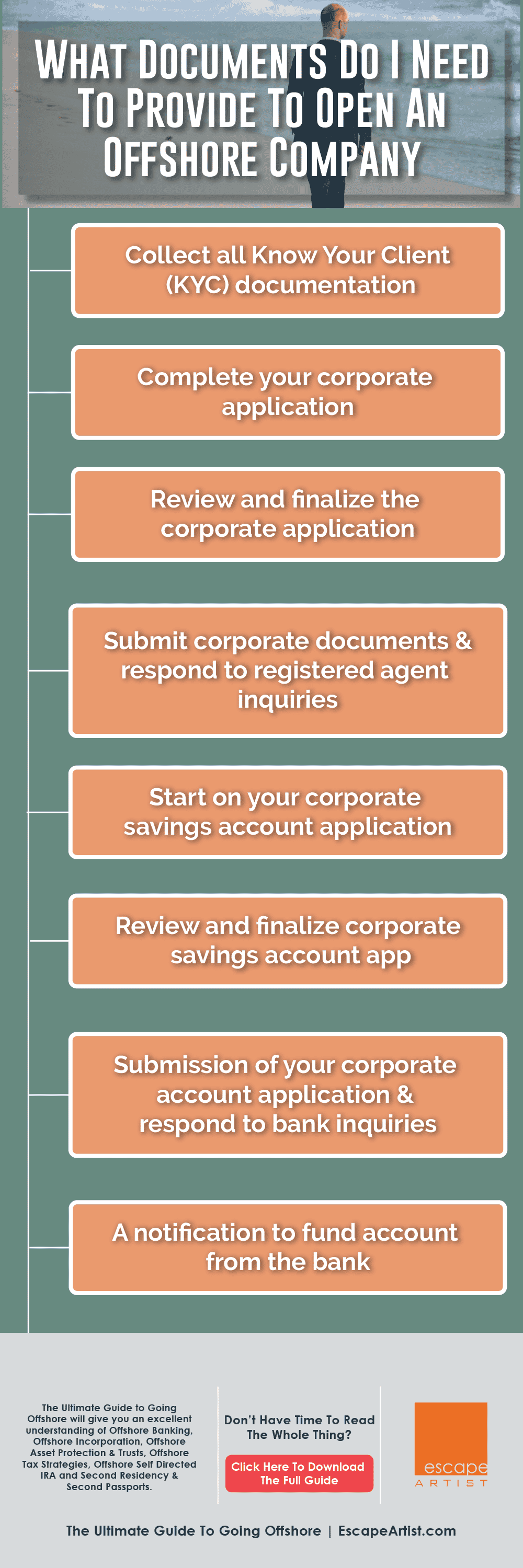

What Documents Do I Need To Provide To Open An Offshore Company

Each service provider or law firm you work with will have their own list of documents needed to open an offshore company, but traditionally you can expect the following process and document requirements:

- Collect all Know Your Client (KYC) documentation from you

- Complete your corporate application

- Review and finalize the corporate application

- Submit corporate documents & respond to registered agent inquiries

- Start on your corporate savings account application

- Review and finalize corporate savings account app

- Submission of your corporate account application & respond to bank inquiries

- A notification to fund account from the bank

KYC information for maximum compliance would include but not be limited to:

- Notarized colour copy of your passport

- Proof of Residence with a notarized utility bill for proof of residence

- A bank reference letter

- A professional reference letter

You can expect a delivery time of typically 7-14 days for the company from the time the corporate application is finalized. I have seen sites that promise your offshore company in 24-48 hours but in reality, this is rarely the case of how things work out in the real world. My advice would be to work with a reputable company and start gathering the documents in advance to help facilitate the process.

Best Countries To Start An Offshore Company In

I think there are no “best” offshore locations. It’s all a matter of finding the right jurisdiction that can help you meet your personal wealth and business goals faster. Although the guiding principle is always to reduce your tax burdens, facilitate the ease of business and protect your assets from litigation. However, I will say these are some of the more popular options amongst investors are:

- Belize

- Panama

- Seychelles

- The British Virgin Islands

- Hong Kong

- Mauritius

- Bahamas

- UAE

- Singapore

- Vanuatu

- Switzerland

- Gibraltar

- Jersey

Virtual Office Or A Physical Office Offshore

One thing you need to remember is that you might need an address to register your company premises at and maybe a small office to make it work, but the rest can be managed rather easily by your service provider who should be able to help with a virtual office or a physical office for your mail. Standard services include:

- Registered Physical Address

- Standard or Electronic Mail Forwarding

- Fax Forwarding

- Corporate Email Address

- Corporate Telephone Number

- Receptionist Call handling

There are very few costs associated with creating a company offshore and these services are usually much cheaper than you would imagine that there is no reason why you shouldn’t consider this as a valid strategy to preserve financial integrity.

Conclusion

If you’re looking to develop airtight tax avoidance strategies, then there is no better starting place than having your offshore banking connected to an offshore company in a stable country with strong asset protection and privacy laws. Considering the extra advantages that come with setting up offshore companies, there is no telling where your financial standings will go to if you go down this path. In many cases, you won’t even need to actively engage in the process and you can let your advisors handle the hassle of setting up these companies.

As such, I’ve personally always advised my clients and friends to try to move their business operations abroad. With your organization registered in tax havens, you can save hundreds of thousands of dollars, if not millions in tax rebates and tax exemptions over the years. Then with the other services available to you, you can begin to diversify your investment portfolios and achieve cost levels that your competitors can only dream of.

All in all, with these advantages, I think anyone would be set to live a life of comfort and luxury, without having to fear legal encroachment or worrying about someone taking what’s theirs.

For assistance in setting up an offshore company or a consultation on which strategy is best for you and your business click here.

Handpicked Related Content: How Can I Benefit From Offshore Incorporation?

Asset Protection – An Offshore Trust – The Ultimate Guide To Going Offshore

Your long term financial well being depends on effective tax planning. As I tell all of my clients, setting up a trust is the ultimate way to avoid excess taxes involved with estate planning, cutting down the tax on profit and various other forms of taxation. The United States isn’t very friendly to those belonging to higher income tax brackets, charging all sorts of taxes including those on luxury items, inheritance, and property. As such, it makes sense to reduce your tax burdens as much as possible and offshore trusts are one of the best financial tools at your disposal.

You’ve made your money keeping in mind that this might be passed on to someone later down the road. The transfer of assets from one person to another can be subjected to as high as 40% on estate transfers, while capital gains taxes can go as high as 20% and it becomes essential that you save on this as much as you can. There can be no better way to do this than to go set up a trust fund and then to take it offshore to get further tax cuts.

Why Do You Need An Offshore Trust?

The United States and many other countries around the world are absolutely the worst when it comes to protecting the wealth of the individual. The tax rates across many developed nations, as well as some developing nations, are immense; comprising of a diverse set of state-sanctioned taxes ranging from personal income to wealth tax. A lot of people find that they’re paying tens or hundreds of thousands of dollars in taxes every year which can make a huge dent in your financial integrity.

Tax on individual wealth is one of the most abhorrent regulations that I’ve ever seen. As a financial libertarian and even an avid economics enthusiast, I think that these represent state-sanctioned inefficiencies that are just bad for the individual and for the society in the long run. Having worked all your life to accumulate an enviable amount of wealth, it’s only right that you get to enjoy this money because you’ve earned it. How can it ever be justified that the state takes that money from you to “redistribute” it in response to its economic imbecility?

Considering everyone’s rights from the economic exploitation at the hands of coercive political powers, it’s only right that we take as many steps as we can to protect our assets from state-sanctioned encroachment. Trusts and Trust funds are some of the best ways for people to protect their assets because these trusts are largely protected from taxes and can be used to supplement your tax avoidance strategies.

Is Tax Avoidance Through Trusts, Legal?

There is a very subtle difference between tax avoidance and tax evasion. Tax avoidance is the exercise of declaring all of your assets, where the tax exemptions allowed by the state are taken advantage off. These strategies minimize your tax burden rather than completely doing away with it altogether. Tax evasion, on the other hand, is in a way lying to the state about your assets to avoid paying taxes on them altogether. If you’re misleading the state into thinking that you don’t possess certain assets, then that qualifies as full-fledged tax evasion that holds you liable for legal and financial penalties. Although I whole-heartedly oppose tax of all types, I follow the laws of the country I am in and advise my clients to always do the same, as I have no interest in being thrown in a cage and having my freedom ripped away from me.

Trust funds do not lie in the ambit of tax evasion because you’re not hiding any assets from the state at all. You’re just placing them in a fiduciary agreement with a third party, which will look out for them until these can be passed on. There is an entire list of trust funds and trusts that you can set up to protect your assets under completely legal circumstances while paying very few taxes on them if any at all, a good company to contact for these types of services is Georgetown Trust, I actively work with them and have found them to be extremely knowledgable in all types of offshore services.

Planning Out Your Tax Strategies Through Trusts

Considering the high tax rates imposed by the state, it only makes sense that you plan out the future of your finances years in advance, keeping in mind how much your wealth will grow. In this process, you’ll need to assess what you intend to do with the money, who it would go to in your absence and how you can keep it preserved against any government in encroachment in the form of your taxes. Like most financial advisors, I think that financial and tax management is essential if you’re trying to develop and sustain your wealth, and trust funds form the core of the many financial plans I give my clients.

Before we can get into a discussion about how Trusts can be used to avoid taxes, much less offshore trusts and trust funds, it’s only right that we discuss what a trust is and the various options that you have. You’ll have different advantages using different trust funds, each of which will tackle a specific set of tax issues for different people that you might want to pass on your wealth to.

At its most basic, a trust fund is a way to pass on your wealth to your spouse, children, mistress or anyone else you like without being subjected to the taxes that come with such a financial transaction. In many cases, you can still choose to retain control of the assets in the fund and to change the terms as and when you see fit. This ability to change who owns the trust, if used wisely, can be a great way to avoid taxes.

What Is A Trust And How Does it Protect You?

A trust fund is an agreement between three people, where a trustor is handed over property by a trustee which can then be passed onto a beneficiary. The intention is to make sure that the terms of a will are enforced, aren’t revoked and the beneficiary is protected from both legal and financial exploitation.

There are various types of trust funds, the most common categorizations include revocable, irrevocable and some of them are turned into investment funds to deliver a greater amount of money to the recipient.

The Types And Advantages Of Trusts

The tax advantages of a trust depend on the type of trust you’ve created. These can include:

Revocable Trusts

Revocable trusts are those where the trustee retains authority over the assets included in the trust. Therefore the trustee can do as they please with the trust until they are alive and whatever gains or leftovers they leave being can be passed on to the beneficiary.

The advantages of a revocable trust include exemptions from the probate process, which is a rather long and drawn-out process.

Life Insurance Trusts

Life insurance trusts are a form of irrevocable trusts because the trustee does not have the authority to make any changes to the assets held in these. These are exempt from estate taxes whenever the assets are released into the beneficiary’s authority, upon the demise of the original trustee.

Credit Shelter Trust

These trusts are commonly used by married couples to avoid estate taxes, in addition to state and federal taxes.

Qualified Personal Resident Trusts

These are used to pass homes to the beneficiary, where the trustee allows the trustor to live in the home and is later passed on to the beneficiary at a lower tax. These are also a great way to avoid estate taxes and avail the highest possible estate tax exemption.

Spendthrift Trusts

These are designed to avoid creditor claims on any assets that need to be passed onto a beneficiary. The trustee would give the trustor control over certain assets and payments are made to the beneficiary through the trustees.

Why Use An Offshore Trust?

Considering the high tax rates applied to estates and assets, a trust is a great way to avoid these obligations and maintain the monetary values of these. Going offshore adds to the tax advantages of the trusts because of astoundingly low tax rates in many tax havens, as well as the access to previously inaccessible investment opportunities.

In many ways, a trust is a separate legal entity which takes on the responsibility for the assets placed in its care. The laws and financial regulations applied to these differ from those applied to individuals. As such, the transfer of funds and authority over assets won’t be subjected to high tax rates that are characteristic of personal, individual to individual transactions. With an offshore trust, it’s entirely possible that you do away with any tax burdens altogether while at the same time get to enjoy all of your assets.

Think of it like this, once you’ve set up a trustor in an offshore, low-tax region; the money and the financial obligations incurred will be dealt with according to the laws of the offshore location. So if you have a trust set up in Hong Kong and you’re also transforming it into an investments portfolio, then you don’t have to pay any taxes on capital gains earned on that portfolio.

Considered to be one of the freest economies around the world, Hong Kong is also the hub of specialist financial services that focus on portfolio and investment management. If you have assets as part of a trust set up in the country, then this is a virtually tax-free source of income and finance that will continue to grow without you having to worry about managing these yourself.

Setting Up An Offshore Trust Or A Trust Fund

Clearly, when you’re handing over the ownership or partial control of your funds to a third party, you need to be careful. These decisions require much thought because your money and the future of your dependents are at stake. You need to find a trustworthy 3rd party that would be willing to execute the terms of the trust whether or not you are physically present without fail.

Luckily, there are great companies that will act as trustors for your trusts and trust funds. These companies comprise of experienced legal and financial experts who will help grow your wealth to keep it sheltered and grow as you sit back. When combined with the tax exemptions, your funds will be preserved when you pass these on or, if you’re working with a revocable fund, when you claim them again.

They try to simplify the process as much as they can, where you just have to fill out some forms and pay the fees, which will then be used to set up your trusts. On occasion, you might have to fill out certain forms to ensure that all the tax documentation is correctly maintained, but beyond that, there is very little that you will have to do.

Conclusion

Your financial well-being should be your ultimate goal because it’s the only way you can live the life of your dreams. With your efforts in developing your wealth over a long and fruitful career, it’s only wise to make sure that you preserve this money. Offshore bank accounts, trusts, and corporations are some of the best ways that anyone can make this happen. When used in combination with one another, you are guaranteed to save a significant chunk of your funds against taxes and can enjoy a greater part of your income than ever before.

If you would like assistance in setting up an offshore trust reach out to us here.

Handpicked Related Content: Five Primary Examples of Offshore Asset Protection Benefits in Belize

Understanding Tax Strategies While Offshore – The Ultimate Guide To Going Offshore

There are many perks to living on a tropical island. You’re surrounded by sandy beaches, blue skies and don’t have to deal with the hustle and bustle of living in a crowded city. But even when you’re soaking in the sun of some island in the Caribbean, there is still something you can’t escape—your taxes.

There’s this misconception that living on an island will exempt you from the taxes that the rest of the schmucks have to pay but just because you’ve chosen to physically go offshore.

So what are your options as an American living abroad who wants to reduce their taxes? Although taxes are different for everyone, here are some of the things you need to know about reducing them while going offshore.

Foreign Earned Income Exclusion (FEIE)

Generally, Americans and resident aliens are both subject to federal income tax—this includes income earned from abroad. American citizens living abroad can be excluded from taxable income up to $105,900, but for that, they have to meet two conditions (see Step 2).

The “income” will have to be earned from doing a job as an independent contractor or an employee. This excludes money made from dividends, pensions, rent, and interests. Independent contractors that receive a 1099-MISC are subject to (Social Security and Medicare) on their net income.

FEIE Requirements

FEIE has two main requirements:

- You’ll have to set up a “tax home” overseas. This can be either one country or a few countries.

- You will have to meet the conditions of a Bona Fide Residence Test or the Physical Presence Test.

Bona Fide Residence Test

The IRS website details the list of requirements that applicants have to meet.

You’ll have to be a bona fide resident of a different country for a tax year. Although you can still move around, you’ll still have to prove that you intend to stay in this foreign country full-time.

In order to prove your intent to remain in the country, you’ll have to do the following:

- Set up a home in a different country. You can show this by presenting a long-term lease contract or actually purchasing a house

- Actually live in the country

- Live there with a family

- Filing and payment of local taxes

- Health insurance, bank accounts and driver’s license – things to show strong ties to the country.

The Physical Presence Test

To be considered “physically present”, you’ll need to be in the foreign country for at least 330 days during the course of a 12 months period.

The Physical Presence Test doesn’t take into account your intention to stay for the long-run, whether or not you want to return to the US or the reason you’re choosing to stay abroad in the first place. It’s only looking at whether or not you’ve stayed in the country for a total of 330 days in a during a 12 month period.

You’ll also have to look into the local tax laws of the country you’re living in. Many popular overseas destinations such as Panama, Hong Kong, Seychelles, Taiwan, and Singapore have a “territorial tax system”. This means they only tax income that was made in the country itself.

There are also countries around the world that don’t have any taxes at all. These include the Bahamas, Andorra, the Cayman Islands, the UAE, and Monaco as well as several others.

How Long Can You Travel In The USA With The FEIE

There’s no doubt that you’ll miss home every now and then and will want to visit. However, a trip home will cost you heavily. The rules for the Physical Presence Test are very stringent. You’ll have to be in the foreign country for 330 days, meaning you’ll have to be very careful about the length of the vacations you take—an extra day can cost you a lot of money!

To pass the Physical Presence Test, you’ll have to spend the 330 days IN a foreign country; flying over on international waters doesn’t count, neither does sailing in the open ocean! A delayed or missed flight will not be excused. If you do intend to travel, make sure you leave a cushion for a few days to avoid losing your tax privileges.

Although you aren’t completely exempt from paying your taxes, you can get them reduced substantially by following the above guidelines. Spend some time researching countries that will help maximize your savings and before you decide on a place, take a look at their tax laws, banking rules and regulations, job and business opportunities, etc.

If you need individual tax advice feel free to reach out to the CPA (Chartered Public Accountant) we work directly with. He is excellent and will be able to assist you in making sure you qualify correctly for the foreign earned income exclusion and other offshore tax strategies.

Foreign Bank Account Report (FBAR)

US residents that have foreign financial dealings or signatory authority in foreign financial accounts are required to file the Foreign Bank Account in Report (FBAR). The excuse governments use is that this report helps them uncover tax fraud that’s committed by unscrupulous individuals who hide money in offshore accounts, I say that is slander as it is your right to privacy. None the less, if you’ve just opened a foreign bank account and are clueless about the process, penalties, compliance, and amnesty regulations, read this section of The Ultimate Guide To Going Offshore, it could save you from some massive penalties.

FBAR Filing Requirements

When your foreign bank account touches a balance of $10,000, you’re required to file for FBAR. Two important points that you should know before filing are:

- If the total balance of your multiple foreign accounts adds up to the threshold amount, i.e., if you own three accounts and each has a $3,334 balance, you are expected to file.

- Filing for FBAR doesn’t mean that you’ll be taxed on the account balance. The process is meant to help the IRS keep an eye on your overseas money.

Who Can File FBAR?

If the foreign account isn’t in your name but you have the authority to move funds around, control the disposition of the money, and signing authority on behalf of your employer, the FBAR applies to you.

Individuals who are not required to file the FBAR, even when they have signatory authority, include:

- Employees and officers of a bank working under the Board of Governors of the Federal Reserve System and other financial supervision authorities

- Employees and officers of authorized service providers, i.e., companies registered under the Investment Company Act of 1940

- Employees and officers of firms that have a class of equity securities registered

- Employee and officers of a subsidiary holding a foreign financial account when the subsidiary is included in the consolidated FBAR report of another filer

What Should be Filed For FBAR?

Even though the FBAR filing means that you’ll be only reporting the account balance and no taxes will be levied, you still need to report a few other things. These include:

- Foreign mutual funds

- A financial account opened in a foreign branch of US-based bank

- Securities and stock held in a foreign bank (you can report the account and not the contents)

- Annuity contract or life insurance with a cash value, issued by a foreign company

Filing Exceptions

Foreign financial accounts are required to file the FBAR even if they are not producing taxable income. Exceptions apply to only a few types of accounts, which are:

- Nostro accounts—maintained by foreign banks for bank-to-bank settlements and correspondence

- A foreign financial account held by an international financial institution

- Government-owned accounts such as colleges and universities that are operated and owned by the government

- Individual retirement account (IRA)

- Participants of IRS-approved and tax-qualified retirement plans

- An entity that owns larger than 50 percent stake in another US entity and is named in the consolidated FBAR filing

- Accounts maintained by US military banking facilities

Filing Process

FBAR is filed through the Financial Crimes Enforcement Network’s BSA E-Filing System and not through the IRS or with the federal tax return. You can only file electronically since paper-filings are not accepted. You can either file as an individual—if you personally own the account or with a spouse—or as an institution. Filing as an institution implies that you’re either an attorney or an agent filing on behalf of a client.

The process is fairly straightforward; you’re required to enter all the pertinent information on the online form and submit it. The information includes:

- Foreign, US, Permanent and temporary address information

- Phone numbers with proper formatting and area codes

- Account number

- Alien registration number

- Employer identification number

- Passport number

- Social security number

- Aggregated amount rounded up to the next whole dollar (if your account has a non-US currency, convert it to dollars using the Treasury’s Financial Management Service rate.

If a third party, i.e. a CPA, an attorney, or certified tax preparer is filing for you, you need to grant them the authority to do so. As an individual, if you hold a joint account, you can file on behalf of your spouse by asking them to sign for Form 114a — FinCEN.

FBAR Deadline

April 15th is the official due date for FBAR filing, however, US citizens living abroad can file till the end of June. The June 30th deadline cannot be extended; failure to file may subject you to penalties worth thousands of dollar.

An extension can be granted until October 15th but may be subject to a written explanation.

Penalties For Non-Compliance FBAR

Foreign account holders are subject to penalties in three cases. These include:

- Failure to comply with the requirements

- Filing past the due date

- Willful failure to report

With a reasonable cause and accurate filing, you can avoid penalties altogether. A civil penalty of $10,000 or less is imposed if you fail to meet the requirements. If you purposefully failed to report, you can be subjected to a fine of or greater than $100,000 or 50% of the account balance—whichever’s more.

FBAR Compliance Policy

If you’re behind on the filing requirements, you can catch up via Streamlined Filing Procedures; however, you need to meet the eligibility criteria. The program is available to both foreign-based and US-based citizens. Here are three instances when you can qualify for the program:

- Meet the non-residency requirement that’s applicable to green card holders and individuals who are not US citizens

- Failed to file FBAR unintentionally

- Failed to pay tax on income generated from foreign assets

You’ll need to file six years of FBARs and three years of Federal Tax Returns when filing under the streamlined filing procedure.

Final Thoughts on FBAR

As an expat, it’s critical to stay current on all tax regulations and legislations. If you’ve made a mistake in the filing process due to negligence, inadvertence or a simple misunderstanding, there’s no need to panic. You can make a request for extension or provide and explanation of the misconduct to avoid fines.

To avoid this from happening, a reliable CPA or IRS enrolled agent can help you file successfully on time.

Handpicked Related Content: Your Foreign Bank Account Report or FBAR Due Date

Offshore Self Directed IRA – The Ultimate Guide To Going Offshore

I personally find the conventional IRA as an autocratic way of conducting financial management. I’d understand if these were profitable enough to ensure that you can retire on top of a giant pile of money, but these are hardly lucrative enough to help people retire in peace. With safe investments, that doesn’t exactly amount to much, so I don’t see why anyone should go for these. Whenever I speak to my clients, I always tell them to sign up with a Self-Directed IRA (SDIRA) because it gives you so much more room to maneuver and have a greater say in the ways in how your money ought to be invested.

This control over your funds, as is the case with SDIRAs, lets you take on a more active role in how your money is spent and if you know what you’re doing, can be extremely profitable. Because clearly, those running regular IRAs are acting like cowards and may not have their client’s best interests at heart. Always remember how they make their money, from the trades they place within your account, not based on the performance, it’s how many times they buy and sell assets. Even if they are looking out for you, they just don’t have sufficient knowledge to make the best possible decisions for their trustees because they just don’t diversify into a wider selection of investments.

If your current IRA representative tells you it is illegal to invest offshore they are confusing what is written by Congress and what is written as company policy. Make no mistake, it is your right to put your IRA money into any type of investment, as long as it is not classified as a prohibited transaction – basically meaning if the IRS can not tax it then it doesn’t count – so things like precious art, antic cars, rare stamp collections and vintage wine are all no-goes.

It is difficult to quantify the returns to expect from your SDIRA, however, I know the people who’re running their own SDIRA and their financial success tells me that they’re on to something. Clearly, if you have the right advice and if you’re willing to take the plunge, then there can be no two ways about it whether you should have an SDIRA. An SDIRA is the best bet to enjoy possibly the most luxurious and comfortable retirement possible.

What Is An IRA?

Individual Retirement Accounts are investment funds that are available to all citizens of the United States. These IRAs are basically accounts, where you maintain a monthly or annual deposit which is then invested into portfolios managed by investment managers. You can’t touch these funds until the time that you’ve retired and you can’t use them for personal purposes until you’ve retired. These are a legally sanctioned financial cushion for your retirement that you must not use until you’re done with your career.

The usual investments made with the funds in traditional IRAs include those in conventional capital markets such as stocks, bonds and mutual funds. Although there is no legal compulsion to invest in these, most custodians following a conventional investment management path for their clients don’t diverge from these investments. It’s as if 95% of all the custodians got together and decided to only allow the people they work for (you the client) to invest in the markets they choose. As such, they tend to miss out on a lot of advantages that alternative investments offer to ordinary people.

How Is An SDIRA Different From Traditional IRAs?

An SDIRA isn’t all that different from a conventional IRA, besides the minor difference that SDIRAs don’t have autocratic custodians. See, in a conventional IRA, the custodian doesn’t allow his client or trustee to direct any of the funds until these are released to them at the time of their retirements. You have no say in where the money goes, you just have to live with the returns as you get them. This might be fine for many people not well-versed in financial trading or portfolio management, but everyone misses out because of this.

With an SDIRA, your custodian becomes passive. For all intents and purposes, they still have the authority to direct your funds into what they feel are going to be financially beneficial arrangements; it’s just that they only do it when you tell them. When you create an SDIRA, your custodians will act as advisors to only direct investments in the ways that you tell them to. With this, you can send your funds wherever it is that you please for as long as you don’t go into forbidden markets (those prohibited transactions we talked about earlier). Once you shift to an SDIRA, a lot of alternative markets open up to you including but not restricted to:

- International real estate

- Currency markets

- Commodity markets, including lumber plantations

- Cryptocurrencies

- Precious metals

- Start-ups and venture capitalism

You can create a diverse portfolio for yourself that can minimize your risks and if you can make timely investment decisions, there is no reason why you can’t have a mother lode to fall back on one day. See, there is no guarantee that you’ll make a lot of profits with SDIRAs. A lot of these markets are riskier than conventional capital markets, but the fact of the matter is that the conventional markets can also crash any day. With no guarantee of safety and none for a lot of money either, it’s a very clear cost-benefit analysis when you’re deciding between SDIRAs or any other conventional IRA. But for my money, I would rather be the one in the driver’s seat directing things, and if I believe investing in something like physical gold as a hedge against big governments and the federal reserve then I should have every right in the world to put my money there.

Where Does Offshoring Come Into This?

Of the couple of thousand custodians that you could use for your IRA only a fraction will allow you to pick the type of investment you wish to put your money into, these are the SDIRA. Of these SDIRA custodians, only a fraction of them will allow you to invest offshore or in alternative investments in a foreign country.

There are no additional tax advantages (above and beyond the normal tax deferment) to taking your SDIRA offshore that we would traditionally look for when going offshore but it does give you more control over your assets and by holding the investments in an offshore LLC like the Cook Islands, Belize or Nevis and you will gain a greater degree of protection if something happens.

So for example, if you wish to make an investment in a condo in Belize that will be rented out to tourists and something happens, like the fan falls from the ceiling and hurts someone. They will have an extremely tough time coming after anything you own and suing you. Remember, protection and control, it’s what we keep coming back to.

And I guess this is an opportune time to explain that if you were to set up the aforementioned investment in Belize, you would not be able to sleep in the condo on your vacation, this would be classified as Self Dealing, and is not permitted; all investments are just that, investments, not to be enjoyed by you, unfortunately.

So when we say an Offshore SDIRA, what we are really saying is that the investments can be offshore, and the company that holds the investments can be an offshore company and the things that need to purchased to maintain a property or an investment can be done with an offshore corporate bank account, but the custodian itself will always have to be an American. As soon you try to make your custodian a non-American it will trigger an audit, and cause a number of problems. But for our purposes, this is an excellent opportunity to invest offshore in alternative investments, have strong asset protection and make greater returns in a tax favourable manner. Meeting all our needs for going offshore.

How Do I Take My Self Directed IRA Offshore?

At this point you might be thinking that you can just run out there and find a Custodian of your own to allow you take your investments offshore, but remember as we were just saying if you are investing offshore you are most likely going to want an offshore structure to hold it for you, a typical Wyoming LLC is not going to protect you in the way you are looking for. You will need a service provider to assist you with the following:

- Creation of an offshore LLC (that acts as a pass-through entity, although technically you could use an IBC, it really wouldn’t do want we need in this context)

- Corporate bank account

- An Operating Agreement

- An introduction to a trustworthy Custodian who understands these types of setups

- Will collect and approve all documentation

- Assist in the transfer off all assets to the new structure and liaise between you and the Custodian

You’ll find a couple of firms that specialize in assisting with SDIRA, willing to let you take a much more hands-on approach to your retirement accounts. Georgetown Trust is one example of a company that offers expert financial advice to help you make the most of your SDIRA so that you can retire in peace, but more on this later.

SDIRAs In The Context Of Financial Libertarianism

As a staunch financial libertarian, there is more than one reason why I prefer SDIRAs over other investment funds for my clients. For me it’s not just about the money; it’s about the freedom that money brings with it. I believe that everyone has the right to enjoy the fruits of their labour without any interference from anyone else. I believe that it’s our responsibility to reduce the restrictions on the financial freedoms we have available to us because ultimately, money is the only way that we can live our best lives possible.

When you tax people with rates as high as 37%, then you’re taking away the fruits of their labour and you’re sending a message that we will take away your property no matter how much effort went into earning it and we don’t care about our lack of a legitimate claim towards it. This can also be interpreted to mean that you have no right over your own money or your work. I find this absolutely horrific. It’s one of the reasons why I’ve been helping people move money offshore so that they can be saved from this encroachment by the State over their financial assets.

Offshore Investments through SDIRAs is an example of how financial libertarianism applies to the everyday lives of those who’ve managed, through sheer effort, to make the life of their dreams possible for themselves. If you have saved your entire life you should be shown the respect to decide where and how you wish to invest your money, and if you decide to invest offshore then the government has no right to interfere.

How Does An Offshore SDIRAs Fit Into Flag Theory?

The Flag Theory was a set of guidelines that was initially developed by WG Hill, which very effectively captures the principles followed by financial libertarians and advises them on how to save and make more money in a tax favourable manner. It advises people to become “perpetual travellers” to shed the national and civic duties that force them into financial subjugation. Specifically, it advises people to:

- Get two passports to have either nationality protect you from undue legal obligations from the other.

- Move your finances onto offshore locations to save on taxes.

- Have a legal address in a tax haven to cement your tax avoidance strategies.

Later on, additions were made to the Flag Theory which also advised people on how to make better investment decisions. Although these are equally as important a part of the Flag Theory, they aren’t the most important in this specific context.

However, one thing to note is, offshore SDIRAs is a direct application of the Flag Theory that sets the ground for your financial freedom and continued financial growth with your investments. Personally, whether it’s from a financial perspective or based on the principles that I advocate, the offshore SDIRA is one of the greatest financial tools that you possess in the war to preserve your financial liberties.

Looking For The Right Custodian

When you’re trying to improve your returns with an offshore investment in an SDIRA, trust in your financial advisors is absolutely essential. Your financial advisors and service providers need to be some of the most financially well-versed individuals that you’ve met in your life. They need to understand all the legislation and regulation that governs financial transactions and taxation, in addition to knowing how they need to invest to ensure that your returns are maximized.

In addition to this, they need to be willing to let you take the reins on your portfolio whenever you feel like you have to. After all, that’s the only way that you can preserve your financial liberty, by having complete control over your own money. There are multiple companies that you can go for, but a few stand apart from the rest.

Companies like Georgetown Trust comprise of teams of financial experts who can guide you towards financial independence without impinging on your liberties in any way. The company is one of the best service providers that take their clients into full confidence before making any investment decisions and also facilitate setting up a Custodian for your SDIRA to help you enjoy the most luxurious retirements possible.

Conclusion

In my dealings with my clients, I have always tried to offer advice that is in line with my principles and beliefs. Setting up offshore SDIRAs is usually one of the first pieces of advice that I give to them, in addition to directing them to the people at Georgetown Trust. When it comes to your financial wellbeing and liberty, there should be no stone left unturned in terms of preserving it and offshore SDIRA is clearly one of the best ways to do this.

Handpicked Related Content: Best Foreign Investments for a Self Directed IRA

Second Residence And Second Passport – The Ultimate Guide To Going Offshore

Honestly, of the several thousand articles we have published here at Escape Artist about half of them are on how to get a second residency or citizenship abroad. I plan on actually compiling all of this information in an Ultimate Guide To Second Residency and Second Passports, but until that happens I would like to share some of the best options that are available to you via our most popular articles and interviews:

- This Is How To Gain Access To A Second Citizenship

- Fake Citizenship By Investments

- 2019 Best Countries for Citizenship by Investment and Residency by Investment

- Why Should The Global Citizen Consider Cyprus’ Citizenship By Investment Program?

- Getting Residency In Greece

- Take Advantage Of Bulgaria’s New Residency And Second Citizenship Program

- Getting Residency In Croatia

Residency and citizenship offshore is a fundamental element of your offshore journey, If you need assistance in a Residency by Investment or a Citizenship by Investment program then feel free to reach out to us by clicking here, we have decades of experience in these types of programs and can assist you every step of the way.

Bringing It All Together

I hope you enjoyed our Ultimate Guide to Going Offshore. We did our very best to include all of the relevant information for you so that you can make an informed decision, whether you are looking to incorporate your business offshore, wanting to learn more about setting up an offshore bank account, how you can protect your assets, what the offshore tax strategies are and why it’s important to understand them when you take your business offshore and how vital it is for retirement to have an offshore investments in a self-directed IRA.

And as a bonus at the end we shared with you a list of the best articles for second residency and second Passport – stay tuned in the coming months for an entire guide about the many ways this can be accomplished. If you need help purchasing one of these CBI programs then please reach out this us by clicking here.

I’m sure you have a ton of questions, especially if this is the first time you’ve thought about the offshore world. Reach out to one of our specialists HERE. You truly will benefit from our expertise for each step along the way. Whether you are new to the offshore world or an experienced veteran, there is something to learn from the people at Escape Artist. At the end of the day, we want you to be more profitable with more money in your pocket.

Lastly, our Ultimate Guide To Going Offshore can be downloaded in a PDF by Clicking Here, I would invite you to print it out for your personal library so that you can reference it along your journey to greater economic freedom and wealth.

Like Our Articles?

Then make sure to check out our Bookstore... we have titles packed full of premium offshore intel. Instant Download - Print off for your private library before the government demands we take these down!